Heading for Warmer Climates

The media has noticed this pattern — a Bloomberg story from January 2019 was headlined, “South Florida Mansion Sales Surge as Tax Exiles Seek Savings.” And even President Trump has joined the exodus. In October, he declared himself a Florida resident.

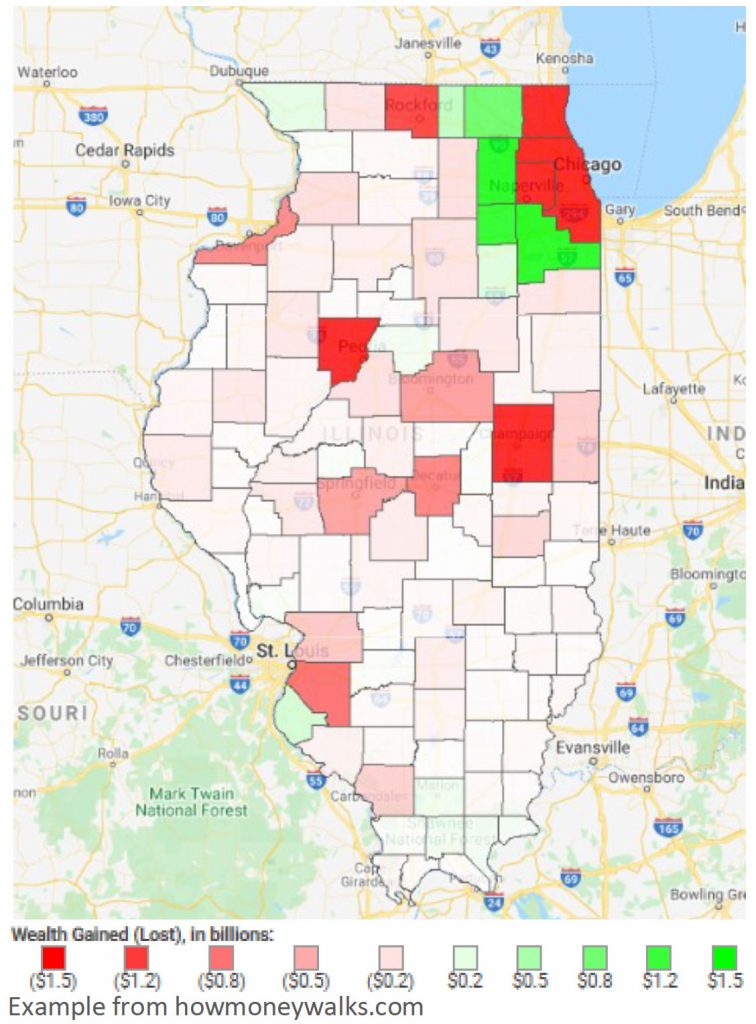

Hard data supports this trend. Check out the website howmoneywalks.com, where you can play with Internal Revenue Service data through an interactive map to see exactly how much money is in motion.

Measure Twice, Cut Once

But don’t be hasty! Before you purchase a property in another state, you need to do some thorough planning and consult a few of your professional advisers, including your accountant, attorney, and financial planner. Double-check everything before making such a considerable change. Why?

Taxes are only one factor to consider. Extended family and health care also are important. Although recent retirees may be heading south or to lower-tax states, many grandparents want to live close to their children and grand-children. Moving away – even for better tax climates – will increase the cost and difficulty in visiting family members. In addition, it is a considerable task for aging seniors to find a replacement team of medical professionals (doctors, dentists, etc.) after a big move.

There are many legal ramifications. The location of your “permanent residence” can determine where you pay income tax, estate tax and which state governs any legal matters. These might include how best to title your real estate assets and how your will is executed. For families with multiple “residences,” care must be taken in identifying which state’s laws will apply. When you change your state of residence, you may need to change other legal documents, too.

Municipal bonds must be considered. Remember those state-specific municipal bonds you purchased? The state income tax benefit you anticipated may not be so valuable if you move to another state. Be sure your investment advisor reviews your holdings.

Two homes are expensive. While an official change of residence may save you some state income tax, if you retain your original property and maintain two primary residences, the costs may be significant. Two property tax bills, two club memberships, homeowner and maintenance fees, cleaning and other fees can reduce the tax savings you were expecting. Here’s where a financial planner can help.

Where Will the Dog Live?

While you may have decided to leave your home state, the state might not be willing to let you go.

Gregory Blatt, CEO of Match.com, found that out when he moved from New York to Texas (a no-income tax state) in 2009. Soon after filing in New York as a nonresident, the state audited him and found him liable for more than $400,000 of taxes, interest and penalties.

Factors vary by state for determining where a taxpayer owes income tax. These may include how many nights were spent in the state, where the state driver’s license was issued, or where prescriptions were filled. Meticulous record-keeping of mundane charges may be very helpful in an audit.

The judge in Mr. Blatt’s appeal made the decision based on where his dog lived, determining that when Blatt moved his large rescue dog from Manhattan to Dallas, Texas was clearly the family’s home.

You Stay, Money Goes

While your desire to pay less state income tax may be great, changing your residence and lifestyle may not be as simple as you imagined. Instead, consider staying where you are and moving your investments out of state.

Trust income is taxed by states from as little as 3% up to 12%. Some states charge none. Favorite zero-tax states include Alaska, Nevada, and South Dakota.

Moving trust assets requires changing the legal jurisdiction of the trust (aka situs) and having a local trustee. Consult your attorney and tax advisor to get more information about this option.

Look Before You Leap

When cocktail party conversation turns to property, state income, and estate taxes, it may be easy to angrily declare, “We’re moving!” But don’t call the moving truck before educating yourself. Do some careful planning. Especially for complex wealthy families, moving to a lower tax state can be complicated and the cost of making mistakes with estate tax, income tax, or other financial concerns can be expensive.