On Your Mark, Get Set, Call Your Estate Attorney

A day in history when 3 million Americans may suddenly call their estate attorneys or tax accountants.

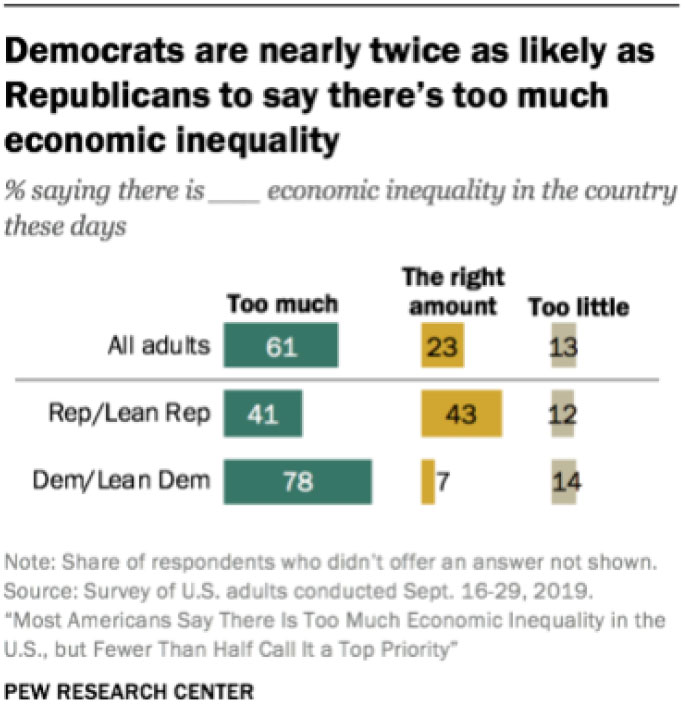

Think about it. Democrats in the White House. Democrats in Congress. Economic recession. City, state, and federal budget deficits. Healthcare deficits from a system wrestling with COVID-19. And wealth inequality – an increasingly politicized issue with 78% of Democrats saying there is too much economic inequality in the country.

It’s a potential “perfect storm” for the 1%, because where do you think America will turn to solve its money problem?

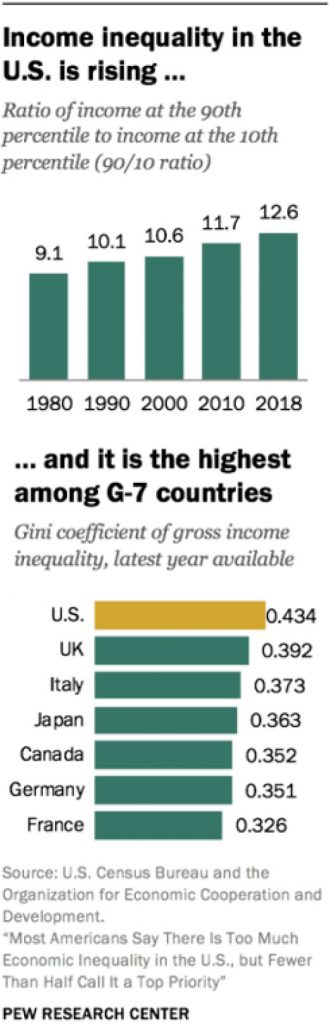

Wealthy Americans should not complain. They have benefited greatly from low interest rates, a rising stock market, federal entitlement programs, lower income taxes, and high estate tax exemptions. Whether economic research focuses on the Top 5% or Top 1% of wage earners, the wealth of these segments of the population has outpaced all others.

Depending on the election’s outcome, taxpayers may expect higher federal marginal tax rates and lower deductions. Carried interest and charitable giving will come back under scrutiny. Illinois taxpayers will be voting on progressive tax rates. Federal estate taxes, with an exemption of $23.16 million for a married couple in 2020, also may be scrutinized.

Bottom line: If you haven’t spoken to your tax accountant or estate attorney since 2010 when the federal estate tax went to $0, it’s time to get to work.

Updating your estate plans and understanding your estate, gift, and income tax liabilities is important for every wealthy family. Rules are complex and penal-ties for errors are significant.

Conifer Bay Capital encourages many wealthy families to hold annual meetings with tax accountants and review estate plans every 3-5 years, or more frequently as your family situation changes. Marriages, divorces, grandchildren, large financial windfalls, and major health events are all changes that necessitate an update to your estate plan.

Don’t wait to learn the outcome of federal elections in 2020. Call your estate attorney now to take advantage of current tax law before changes occur.