There’s Little That Is Free About Medicare

by Lindsay Guido

A client in her 50s mentioned during a financial planning conversation that she decided to work through her mid 60s because that is when she will qualify for Medicare health insurance. When we asked how much she expected to pay, she was very surprised and asked, “Isn’t it free?”

This is one of the great healthcare myths, and a very common misperception by many people approaching retirement. While Medicare coverage is available to all, comprehensive health coverage is not free, and Medicare costs are not the same for everyone. Nor does Medicare cover all healthcare expenses in retirement or provide funding for long-term care. In addition, timing is everything. If you wait until your 65th birthday (or the three months afterward), your Part B coverage gets delayed and could cause a gap in coverage. You may also get late enrollment fees.

THE FINE PRINT

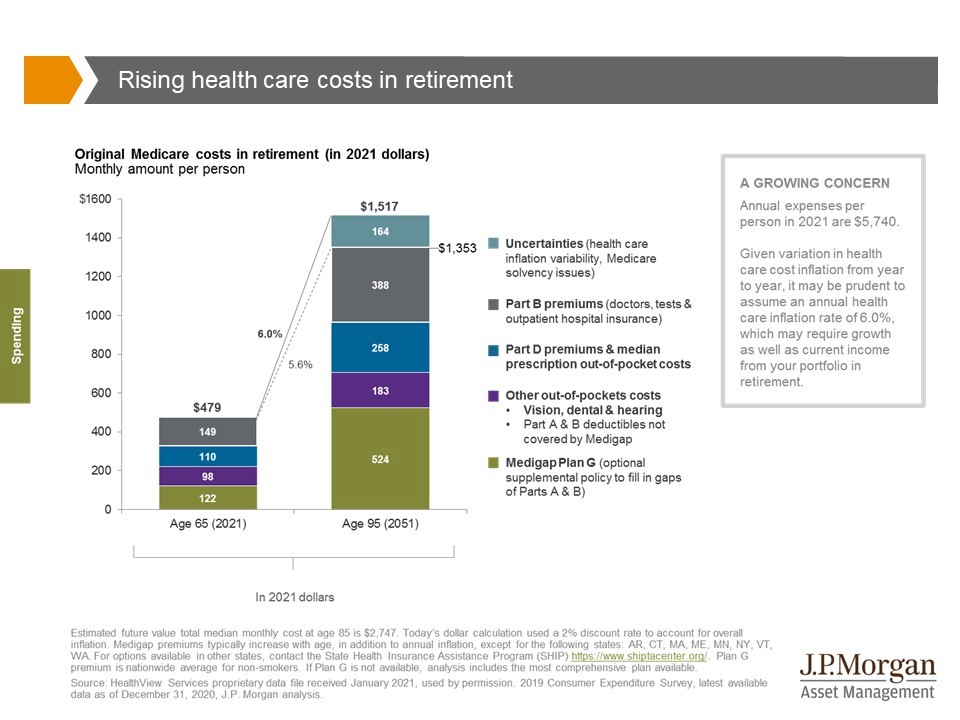

Medicare Part A, which primarily covers hospitalization, is free for those who qualify. It is paid for from employer and employee payroll deductions throughout a person’s working years, but this is not the whole story. If someone chooses full coverage – which includes Medicare Parts A, B, D, and Medigap (see details below) – they should budget for an estimated additional $5,000-$10,000 annually. Understanding the program’s specifics is key to planning for Medicare costs. There are vast numbers of options, but careful planning and research will provide an educational foundation to build a comprehensive health plan in retirement.

Two key things to understand are eligibility and timing. Everyone who is eligible for Medicare must be extended the option to participate in their employer’s health plan if available, and Medicare will always be secondary to it. Enrollment timing can affect costs through late enrollment penalties.

THE BREAKDOWN OF COMPONENTS

LOOKING AHEAD AND GETTING ADVICE

Even with a wealth of information on the complexity of the Medicare system, we also must account for possible increases in medical insurance costs in the future. This attached chart from JP Morgan illustrates a breakdown of the current cost components and possible cost increases in the coming 30 years, assuming an increase of 5.6%-6.0% annually.

Financial planning advice can be valuable in discovering ways to qualify for cheaper coverage. Managing income down in retirement can benefit individuals through lower Medicare premiums. This is possible using two tools, Roth conversions to reduce RMDs and Qualified Charitable Distributions from IRAs.

Medicare planning may seem treacherous on your first initial exposure to all of the options. Conifer Bay can help you budget for Medicare expenses in the future, but we advise any clients to consult a Medicare consultant to explore options that are right for them. Please contact us for more information or redirection to additional resources.