INVESTMENTS

Following 2021’s positive returns in almost all asset classes, global markets retreated early in 2022. The S&P 500 finished the quarter down 4.6%. International and Emerging Markets also experienced downdrafts to start the year, as did fixed income investments.

The perfect storm of raging inflation, the invasion of Ukraine, and anticipation of a higher interest rate environment weighed on investor confidence and broadly contributed to declines in equities and fixed income prices during the quarter. The few exceptions were commodities and energy investments.

‘Unrelenting’ Inflation

Inflation has been surging during the past few quarters. Globally, price increases are rampant. While Energy was a significant contributor to inflation (+27% year-over-year in January), it is more broad-based than that: food inflation is up 7% and Core CPI is up 6% year-over-year. In fact, over 80% of the items in the “inflation basket” are running above 4%.[1]Every year the Bureau of Labor Statistics compares the price of a specific “basket of goods” (which includes basic foods, housing, transportation, household goods, recreational expenses, … Continue reading

The Headline CPI (shown below in light blue) for January of 7.5% was the highest in nearly 40 years and almost twice its 50-year average. Rising inflation – reflected in higher prices for cars, gasoline, furniture, and groceries – means the average U.S. household is spending an extra $276 a month, according to a Moody’s Analytics analysis.[2]The Wall Street Journal: Higher Inflation Is Probably Costing You $276 a Month, 2/10/2022 Renewed constraints in global supply chains due to the recent COVID lockdowns in several major Chinese cities are pressuring inflation to the upside.

Interest Rates Rise

The Federal Open Market Committee (FOMC) took its first step in addressing the persistently high inflation data by raising the Fed Funds Rate in March by 0.25% for the first time since 2018. The FOMC further signaled that more rate hikes would be coming and that these follow-on increases may be larger in size. Many central banks around the globe also are raising interest rates to rein in runaway inflation in their regions.

Keep in mind that it generally takes at least one year for changes in monetary policy to have an impact on the economy. Given this lag, investors may question whether central banks have done enough to rein in inflation. And Investors who remember the inflationary environment during the 1970’s may be anxious for the Fed to act swiftly and significantly enough to prevent a repeat of history.

The inflation trajectory remains crucial for markets. If inflation starts to normalize, global central banks, including the Fed, likely will be more patient with their monetary policy decisions, limiting the slowdown in global economic growth. If inflation continues to gather steam, the Fed may act more aggressively, potentially inducing a recession to bring inflation back to target.

It takes time for any central bank action to work its way through the system, so the coming quarters will gauge how well the Fed and other global central banks fare in managing inflation and hopefully avoiding a recession. As of now, Conifer Bay Capital does not anticipate a recession this year given the strength in the labor market, robust corporate and consumer spending, and strong household balance sheets. However, we will continue to monitor the data and invest accordingly.

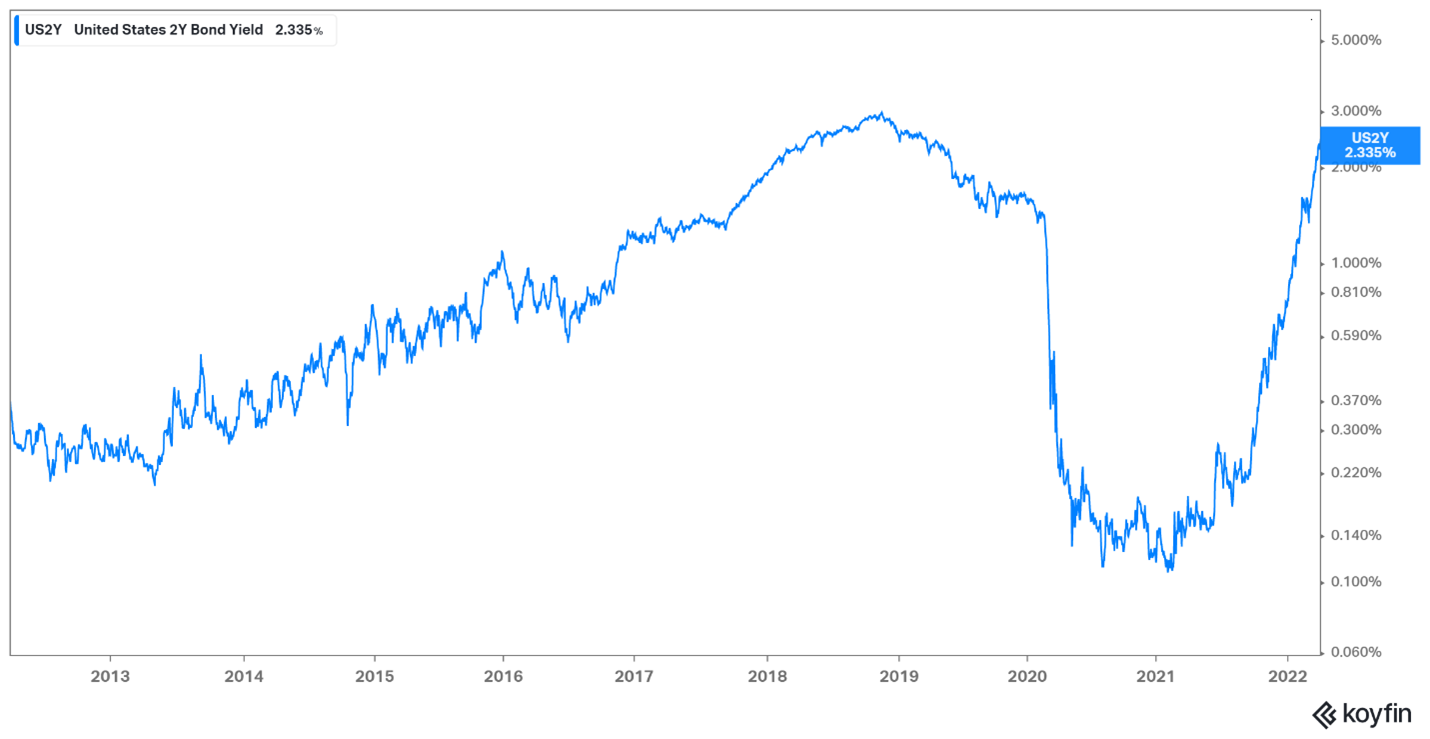

Meanwhile, the tone on interest rates shifted during the first quarter toward more rate increases, larger rate increases, and a quicker pace of rate increases to help ease inflationary pressures. With this, interest rates at the short end of the yield curve increased significantly during the quarter. For example, the 2-year U.S. Treasury began the year yielding 0.73% and more than tripled to end the quarter at over 2.3%. This is a colossal move!

As you can see in the chart below, this puts the yield on the 2-year near its 10-year highs. Unfortunately, given the inverse relationship between bond yields and the price for the underlying bonds, as yields increased, the prices for the bonds fell and fixed income returns were negative during the quarter. We expect a series of rate hikes this year and have generally transitioned our clients’ fixed income exposure toward the shorter end of the yield curve.

Investment Outlook

Portfolios managed by Conifer Bay Capital remain tilted toward the conservative side of asset allocation targets. A typical portfolio holds significantly more cash than normal. While this reserve may be used to buy stocks, it primarily comes out of our fixed income allocation where rising yields have resulted in even short duration investments declining significantly in value.

During the past quarter we also shifted money from international and emerging market equities toward U.S. investments. We previously had been enthusiastic about better performance from Europe and Asia. However, the impact of the Russia-Ukraine war on Europe and the ongoing political issues in China changed our outlook.

We also continue to shift assets toward commodity-sensitive investments in the alternative assets sector. These assets include gold and commodities such as wheat, corn, coffee, sugar, copper, gas, and oil. We also recently added in inverse Treasury ETF that, unlike a traditional bond, is expected to increase in value as interest rates rise. We believe these assets will do well in an environment of rising interest rates and rising inflation.

Looking past the immediate inflation, invasion, and interest rate concerns, we are relatively optimistic about equity investments. Since year-end, valuations have declined on most equity sectors and broad market declines exceeded 10%, the traditional measure of a stock market correction. In the coming quarters, if global tensions and inflationary pressures subside, we likely will be increasing equity market exposure.

Footnotes

Footnotes

↑1 Every year the Bureau of Labor Statistics compares the price of a specific “basket of goods” (which includes basic foods, housing, transportation, household goods, recreational expenses, education and communication expenses, etc.) from the current year versus the previous year. The ratio is the consumer price index (CPI).

↑2 The Wall Street Journal: Higher Inflation Is Probably Costing You $276 a Month, 2/10/2022

Footnotes

| ↑1 | Every year the Bureau of Labor Statistics compares the price of a specific “basket of goods” (which includes basic foods, housing, transportation, household goods, recreational expenses, education and communication expenses, etc.) from the current year versus the previous year. The ratio is the consumer price index (CPI). |

|---|---|

| ↑2 | The Wall Street Journal: Higher Inflation Is Probably Costing You $276 a Month, 2/10/2022 |