Unfamiliar with Family Governance? You’re not alone.

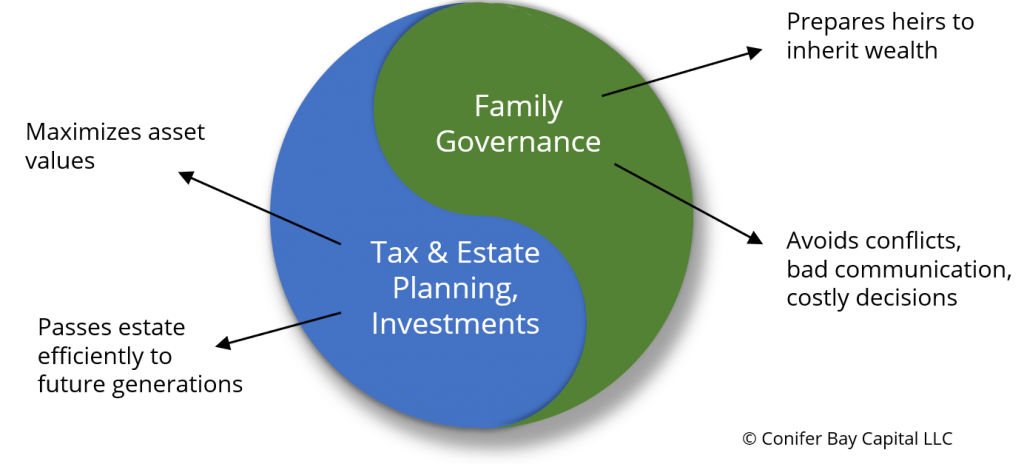

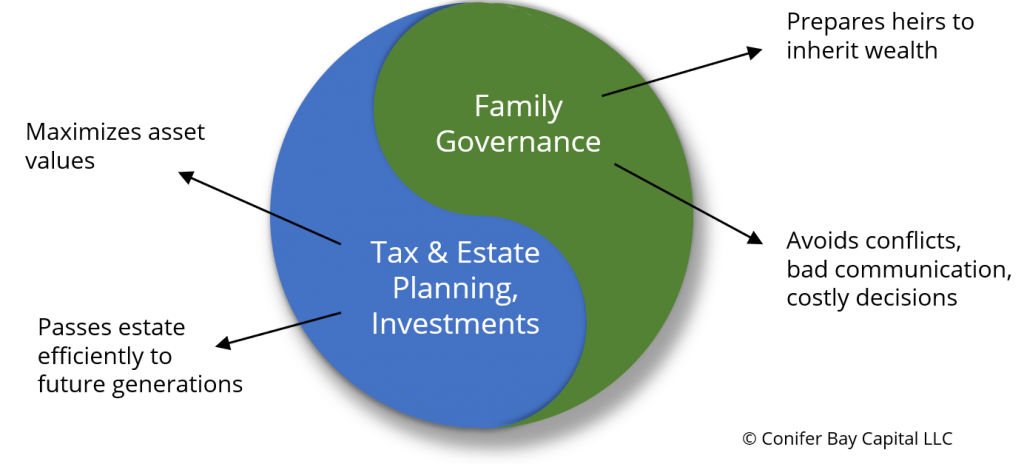

Conifer Bay Capital views family wealth management as having two major pieces. One encompasses your estate plan, tax plan and investments, which are tools for maximizing your assets and efficiently passing them from generation to generation. The other piece is “famiily governance,” which prepares your heirs to inherit those assets.

Family governance provides a plan for how to navigate the complexities of managing a wealthy, multi-generational family. Having such a plan is increasingly important as your family grows and ages, and when you have important shared assets. These may include financial assets (a family owned company or charitable foundation), physical assets (a vacation home), or intangible assets (your family’s history or legacy).

One important reason family governance deserves your attention is that most families focus almost exclusively on estate planning, taxes, and investments. The low-hanging fruit of family governance is often ignored.

The good news is that most families naturally implement key elements of family governance by sharing family experiences, financial literacy, communication, and family history (including ancestry or folklore) in informal ways.

Do you take vacations with extended family members? Do you mentor nieces and nephews? Do you collectively support charities with time, talent, and treasure? These are elements of family governance that reinforce shared values and purpose.

Conifer Bay Capital advises clients on three key aspects of wealth management, including family governance, financial planning, and investments.