Q1:2023 Investment Commentary

Turning Point for the Economic Cycle

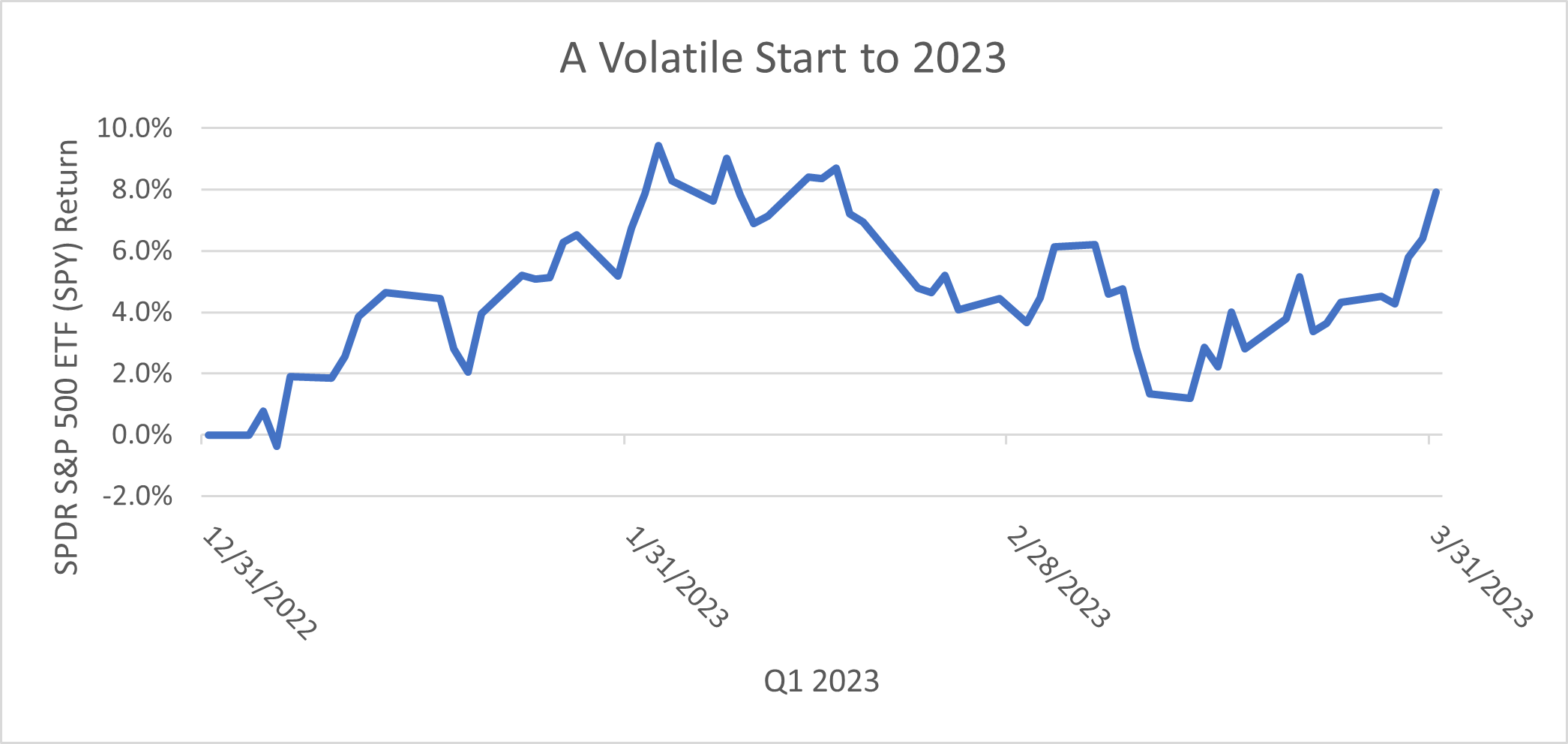

The recent quarter was anything but a smooth ride for investors as enthusiasm for higher bond yields and low equity valuations was tempered by lingering inflation, economic recession concerns, and bank failures.

Investors are no doubt relieved that stock and bond markets produced positive returns in Q1, similar to Q4. The recent gains are making the declines in early 2022 seem like a distant memory.

Source: Koyfin, Conifer Bay Capital

Key Q1 Events

The aggressive pace of the Federal Reserve’s interest rate increases remains front and center. The two quarter point rate increases during the quarter brought the target rate to a range of 4.75%-5.00%, the highest level in more than 15 years.

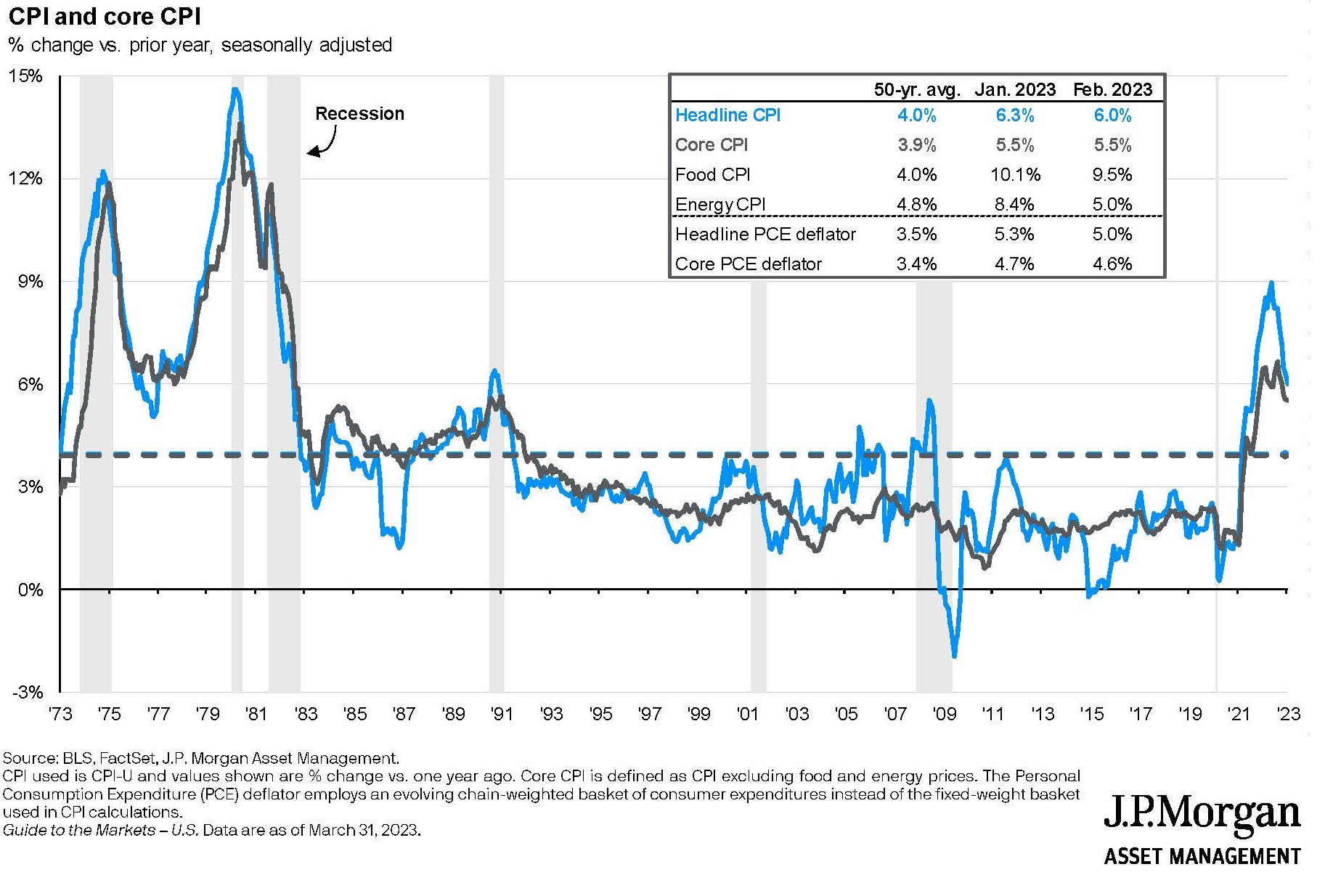

We think the Fed is nearing the end of its rate hikes as recent data suggests that inflationary pressures are declining. The March consumer price index (CPI) report indicated inflation was 6% over the prior year, which is down from the peak of 9.1% last June.

The Fed’s war on inflation is impacting the housing sector with rising mortgage rates making home purchases too expensive to finance. While this may temper home price inflation, it may be one of many factors pushing the economy toward possible recession.

A second key event was belt tightening by tech companies. Following protracted binge hiring during COVID to meet lofty growth expectations, tech companies accelerated staff reductions to rationalize expenses. Apple, Amazon, Google, Microsoft, Meta, Twitter, Salesforce, Cisco, Dell, and IBM all have announced layoffs in the past nine months, impacting cities with high tech employment more than others.

As cost cutting becomes an important theme across industries and geographies, the signs of inflation slowing are starting to become more pronounced. These job cuts will likely help corporate profitability but also are another indication of a weaker economy.

The third key event was the lightning-fast banking crisis, which emerged mid-March claiming Silicon Valley Bank, Signature Bank, First Republic Bank, Silvergate Capital Corp., and Credit Suisse. This banking turmoil, concerns of contagion, and the broad impacts of excessive Fed tightening, all prompted fears of a wider economic slowdown. Fortunately, the banking-related issues from March seem contained and appear somewhat self-inflicted by each institution.

These concerns about the banking industry prompted the U.S. Treasury to step in and insure the deposit base for all affected banks (even for deposits over $250,000), while the Fed elected to hike rates by only 25 basis points, rather than the widely anticipated 50 points. Investors celebrated these decisions and equity markets rose as this indicated that future rate hikes may be coming to an end.

The net result of these recent events is that while stocks and bonds perform well, signs of slower economic growth and increased caution continue to emerge.

Recent Sector Cross-Currents

Performance within the broad equity market varies by sector and in the first quarter of 2023 these differences were substantial. The top two performing sectors were Technology (including Apple, Microsoft, NVIDIA) and Communication Services (Meta, Alphabet, Netflix). In Q1 these sectors were up 22% and 20%, respectively.

The bottom two sectors during Q1 were Financials (Berkshire Hathaway, JP Morgan, Visa) and Energy (Exxon, Chevron, EOG). These sectors declined 6% and 5%, respectively.

So, while the equity markets have remained above the September lows for the past six months, cyclical crosscurrents greatly impacted which companies or sectors performed well or poorly. We believe the magnitude of these differences is another indication that the capital markets are at a turning point as we approach a change in Fed policy and economic trends.

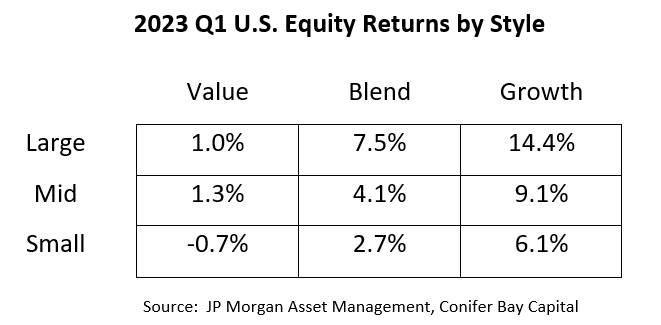

This quarter was marked by a classic reversion trade: growth outperforming value in large-cap, mid-cap, and small-cap. This is a reversal of the prior year, during which value stocks consistently outperformed growth. The table below highlights the performance of U.S. equity sectors:

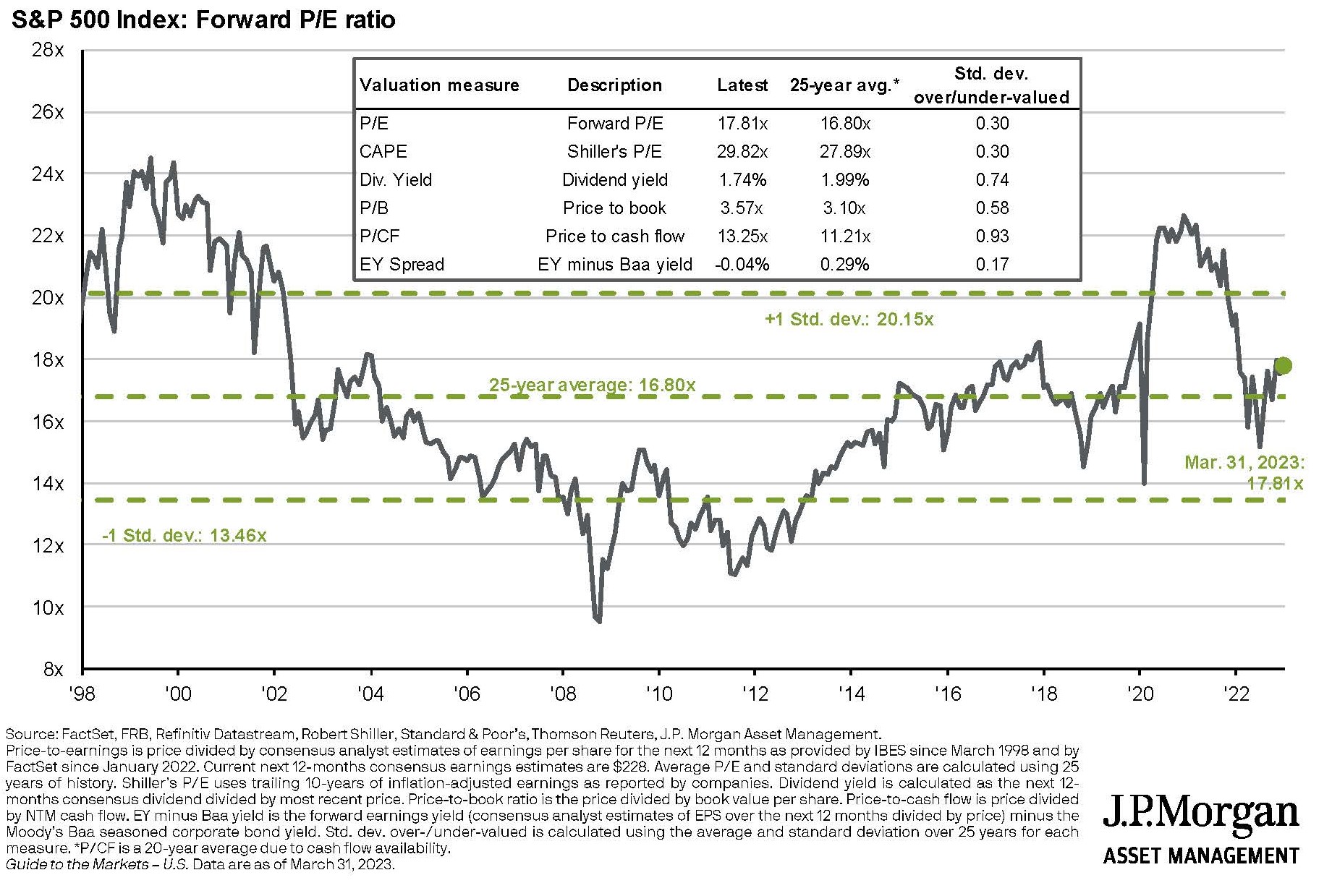

While corporate earnings growth may slow this year, we believe the declines may more directly impact higher valuation growth stocks. Because of this, we continue to tilt portfolios toward value stocks with lower Price to Earnings (P/E) multiples.

Portfolio Positioning

Despite concerns about high interest rates triggering a mild recession, we continue to be cautiously optimistic about the investment landscape.

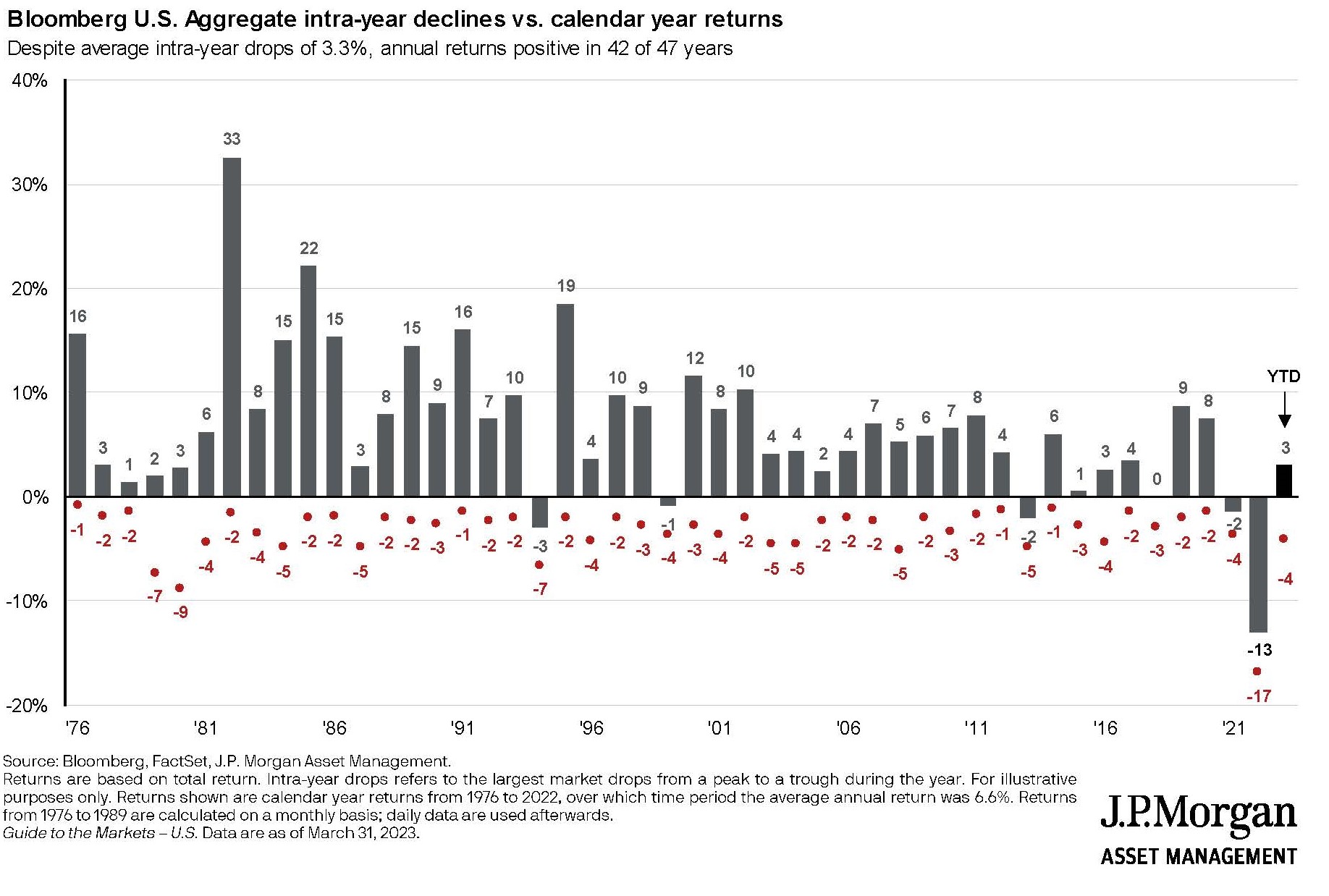

Meanwhile, we are more enthusiastic about bond market investments due to the relatively high level of interest rates, which are now above 5% for many investment grade corporate bonds. Since early 2022 we have been focusing these investments on very short maturity bonds, and cash or money market investments. More recently we have extended these investments to bonds maturing between 1 and 5 years, or longer. Today we hold significantly less cash and equivalents.

As the post-COVID economic situations improve in Europe and China, we have increased our exposure to foreign developed and emerging market equities. Although we remain somewhat skeptical about China due to political and trade conflicts, the local Chinese economy is in relatively good shape. Europe experienced a much milder winter than anticipated, and investment performance has exceeded the U.S. markets for the past two quarters. International valuations are attractive and we are contemplating increasing client allocations to global equities, which should benefit from a falling U.S. dollar.

Outlook

We anticipate the coming quarters to provide more evidence of moderating inflation and a slowing economy. Given moderate equity valuations and high bond yields, this still may be a relatively good environment for investors. Our mantra continues to be “cautious optimism.”

The upcoming corporate earnings season will reveal more data about the impact of cost cutting and layoffs. We expect to see revenue and earnings growth projections coming down but remaining positive for 2023.

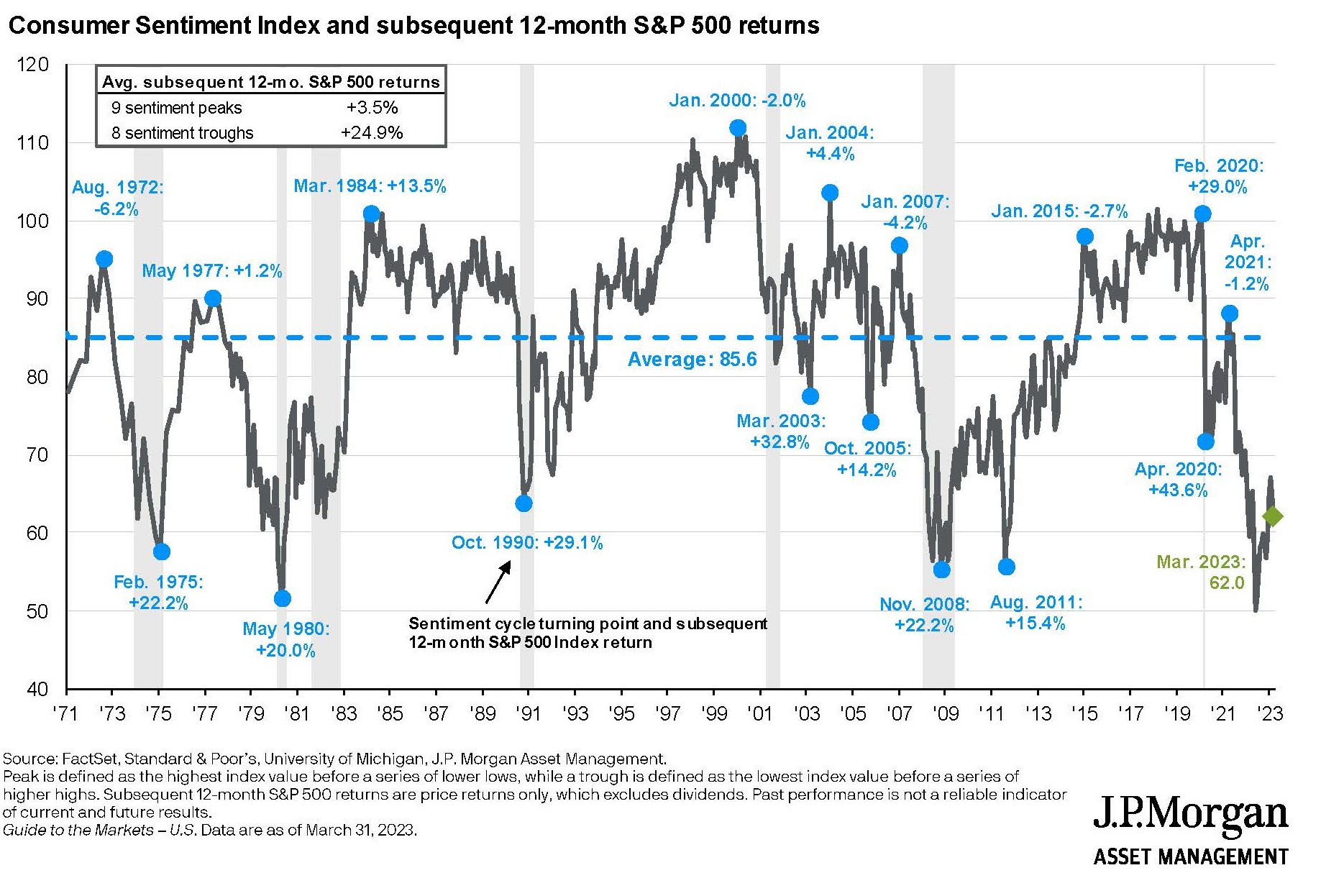

Washington is one of the many possible wrinkles to our outlook, as Congress is approaching negotiations over the debt ceiling limit and 2024 campaign season is about to begin. Consumer confidence is already quite low and combative rhetoric between Democrats and Republicans won’t help. Low consumer confidence is often a springboard for better future returns, and vice versa.

3/31/2023

Graphics source: JP Morgan Asset Management, 3/31/2023, unless noted otherwise.