Stock Market Could Be Peaking

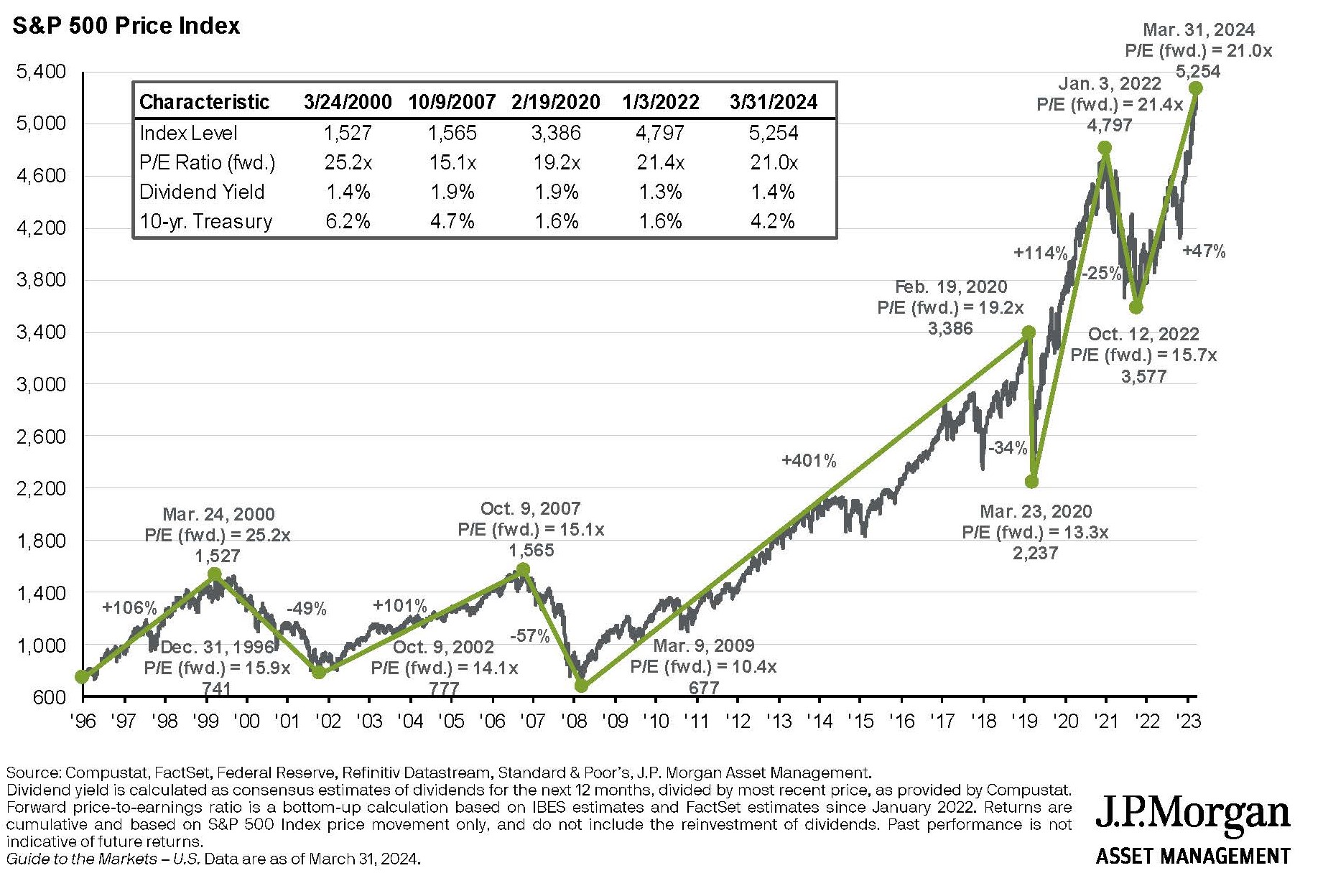

The U.S. stock market is off to a terrific start in 2024 as share prices grind steadily higher. During the first quarter of 2024 the S&P 500 rose over 10%, bringing the 12-month return to nearly 30%.

Major trends over the past 12 months continue, with large companies outperforming small, U.S. markets outperforming foreign, and growth sectors leading value.

Strength in stocks was offset by weakness in bonds as most fixed income assets declined in value. Bond yields drifted higher as expectations for Federal Reserve rate cuts got pushed back from mid-2024 to later in the year, or possibly 2025.

Buyers: Beware! Enthusiasm for putting more money into the market seems to be growing, but investors would be wise to keep their emotions in check. As is often the case, enthusiasm tends to increase after much of the stock market gains have been achieved. As Warren Buffett once said, “Investors are wise to be fearful when others are greedy and to be greedy only when others are fearful.”

Beyond investor excitement there are other indications that the market may be ready for a pause. A rise in the number of initial public offerings (IPOs) of stocks may signal a market top. The first quarter of 2024 saw about 40 IPOs, notably Reddit. The reason for caution is because private equity investors are typically more knowledgeable than others about the strengths and weaknesses of a private company. When these insiders are selling, they may believe the company’s prospects are not as bright.

Another possible sign of a market top could be when a significant number of stocks reach record highs. In March some of the stocks hitting new highs included JP Morgan, Berkshire Hathaway, Costco, Visa, and Eli Lilly.

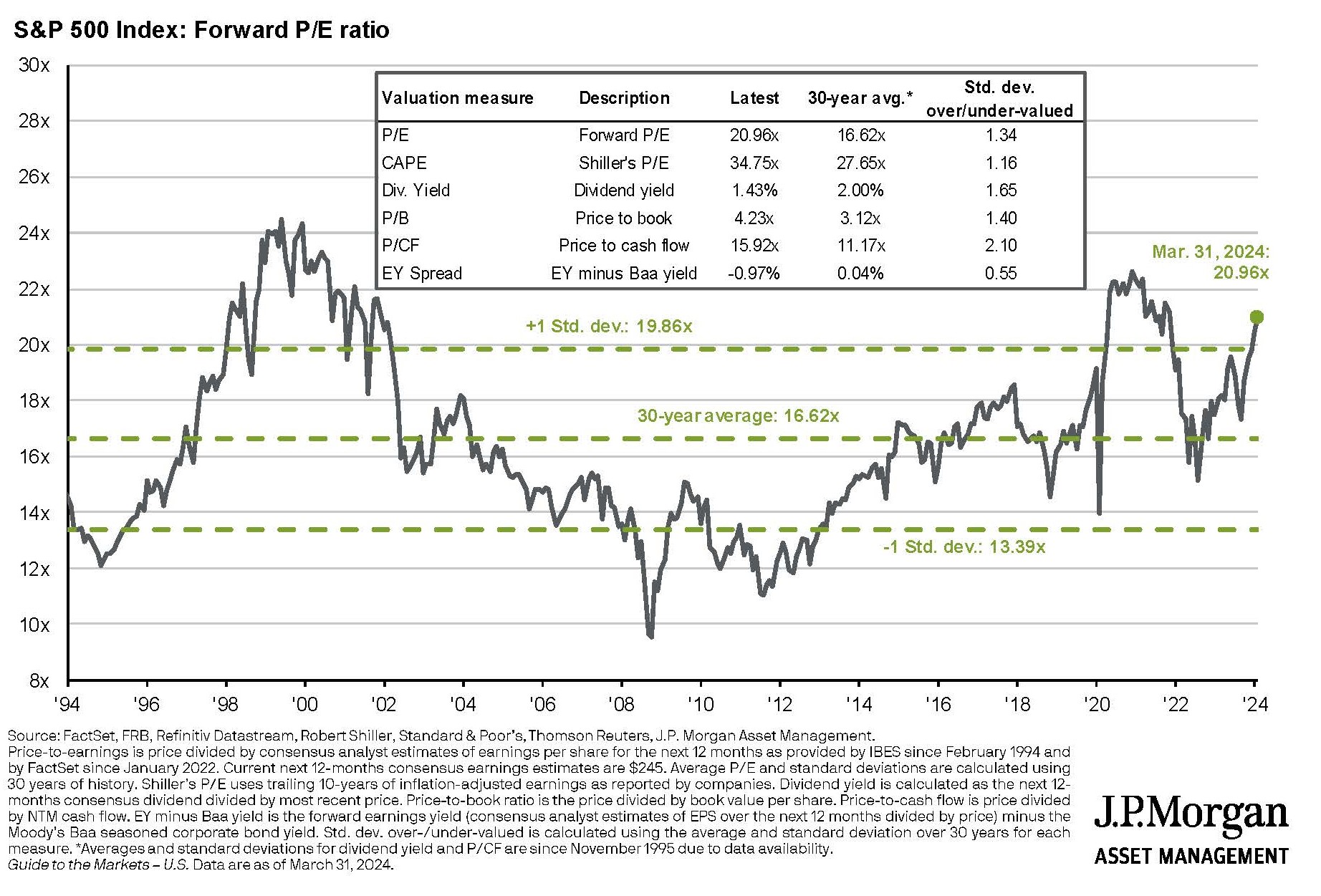

Among the most important market indicators is the valuation of the overall market, such as the Price-to-Earnings (PE) ratio of the S&P 500. During Q1 this ratio rose above 20, similar to the valuation prior to the 25% stock market decline in early 2022.

These indicators do not mean that the U.S. stock market has peaked, or that it will decline in the coming months. However, investors should be aware that the market’s upward trend may pause for a few months, especially as the uncertainty and drama of the U.S. presidential elections approach.

Cracks in the “Magnificent Seven.” For over a decade “FANG” stocks have referred to a handful of high-performing tech stocks including Facebook (now Meta), Amazon, Netflix, and Google (now Alphabet). It later became “FAANG” with the addition of Apple. Recently this group has been reshuffled to become the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla). These stocks are among the largest public companies and have been popular with investors, propelling broad benchmarks like the S&P 500 higher.

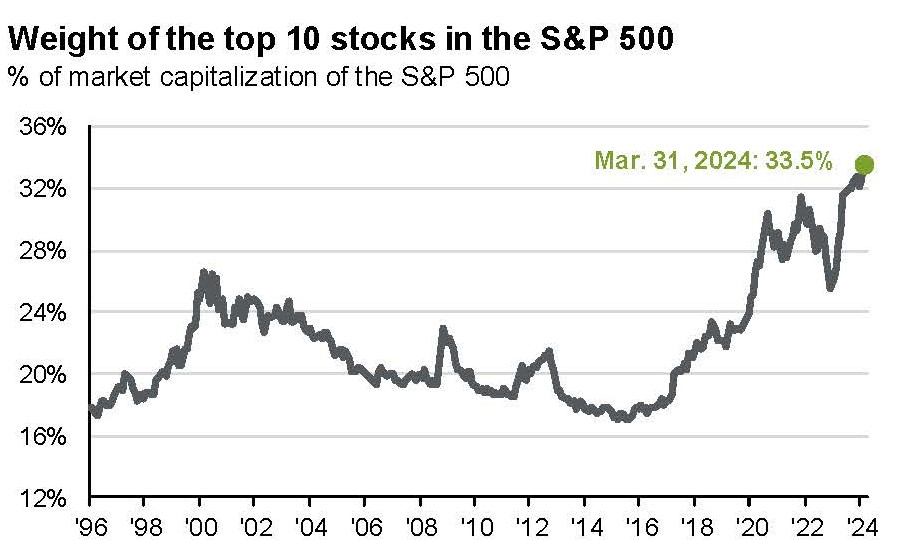

The success of this group has contributed to an unusual phenomenon in which a handful of very large companies is becoming a dominant percentage of the broad benchmark. In the S&P 500, for example, just 10 companies represent over 33% of the index, while the other 490 companies make up the remainder. In the past decade the weight of the top 10 has nearly doubled to 33% from 17%.

Underlying these stocks’ popularity are concerns that their future performance may fall short of investors’ high expectations. Two of these stocks – Tesla and Apple – have declined in 2024.

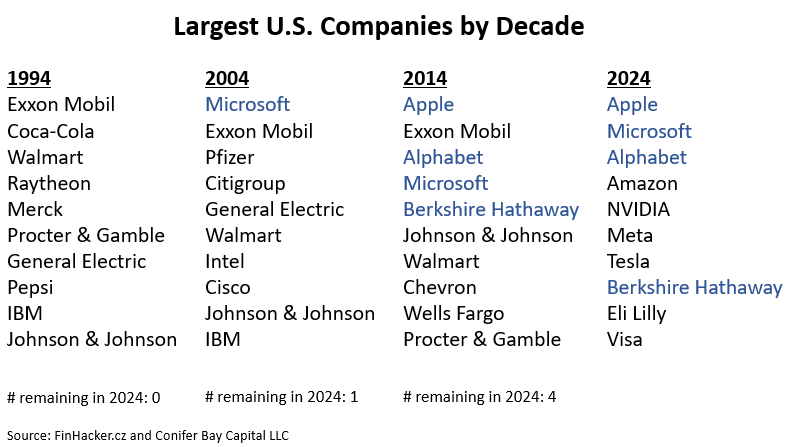

Just because a company is large and has performed well historically does not necessarily mean that its success will continue. The top 10 stocks in the S&P 500 have changed significantly from decade to decade, as seen in the table below.

The turnover among these large companies reflects many factors, including the maturity of a company or industry. Beverage companies like Coca-Cola or Pepsi, which were among the largest companies in the 1990s, simply are not growing fast enough to keep up with young companies that are expanding rapidly in the tech sector. Don’t be surprised if companies on the 2024 list are surpassed in the coming years.

The point is that investors should not be complacent by investing primarily in today’s largest companies, especially if valuations are high. Instead, investors should be looking for smaller, expanding companies that may be on this list in the future.

Investment Outlook We continue to reduce the overall risk in investment portfolios. In past quarters we eliminated high yield bonds, replacing them with U.S. Treasury securities. In the past month we also reduced the percentage of equities in portfolios. We are not anticipating an immediate or significant decline in stock prices, but we want to be prepared to add to our equity holdings if valuations become more attractive.

We are increasingly enthusiastic about bond investments. The yield on corporate bonds today is above 5%, which is an attractive investment return even without the boost of possible Federal Reserve rate cuts in the near future.

Although much of the attention on Federal Reserve policy is on inflation, economic growth, and the timing of rate cuts, we believe investors are missing the most important point. The Federal Reserve today has significant latitude to cut rates whether for economic reasons or in response to a market shock. This is materially different than recent years when interest rates were already near zero, which left the Fed without an important policy tool in its pocket.

3/31/2024