Q2:2022 Investment Commentary

Rising Inflation and Interest Rates Continue to Pressure Markets

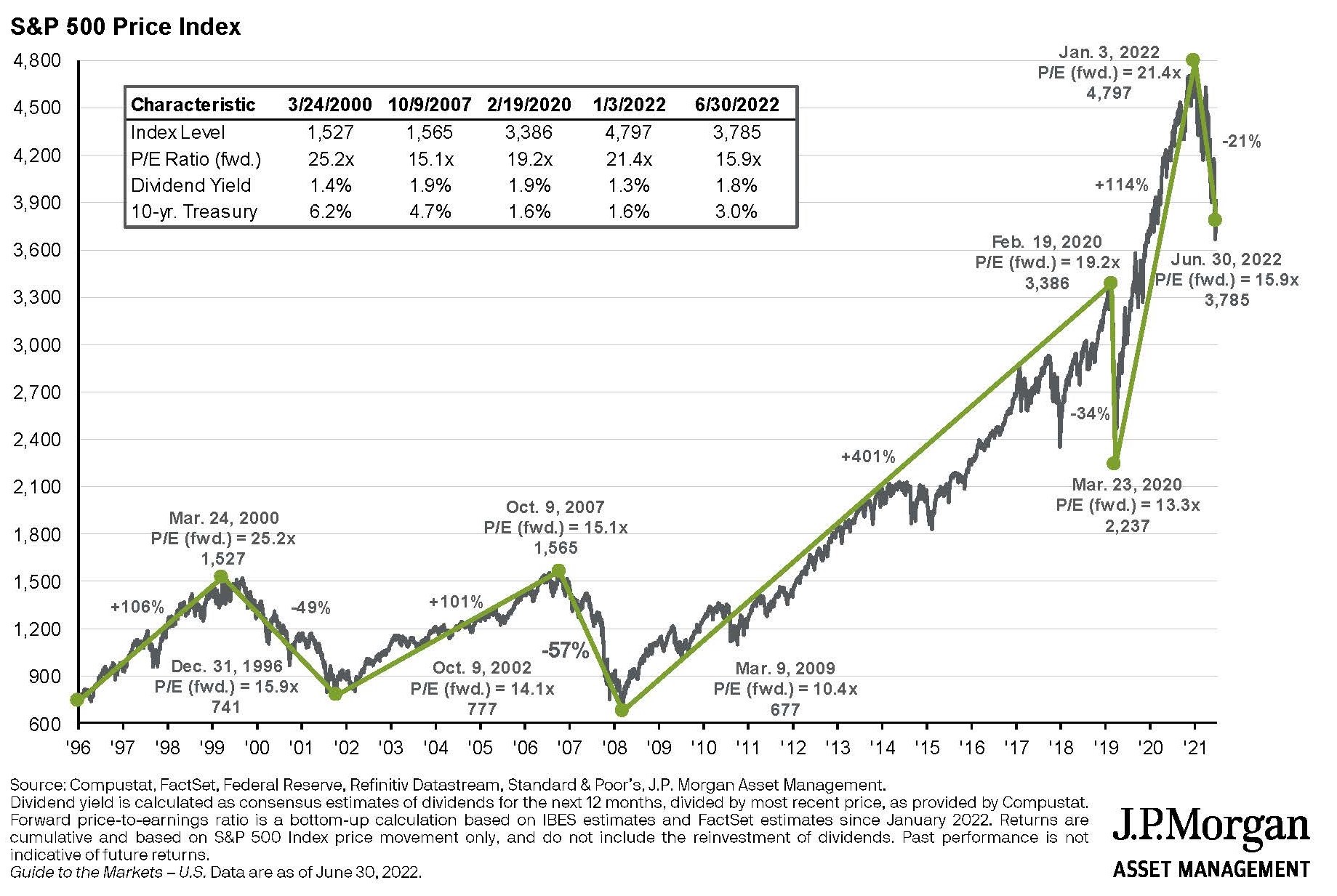

It was a challenging first half of the year for financial markets across the board. Nearly all equity and fixed income markets declined. The S&P 500 fell 16% in the second quarter, bringing the 2022 return to -20%

Inflation Swells

2022 likely will be remembered as the year that inflation moved from a manageable but inconvenient problem to a major market focus. Prices rose at the fastest rate in a generation and dashed investor and consumer sentiment. This breakout inflation drove global market volatility during the second quarter, accelerating the downward trajectory of global equity and fixed income markets.

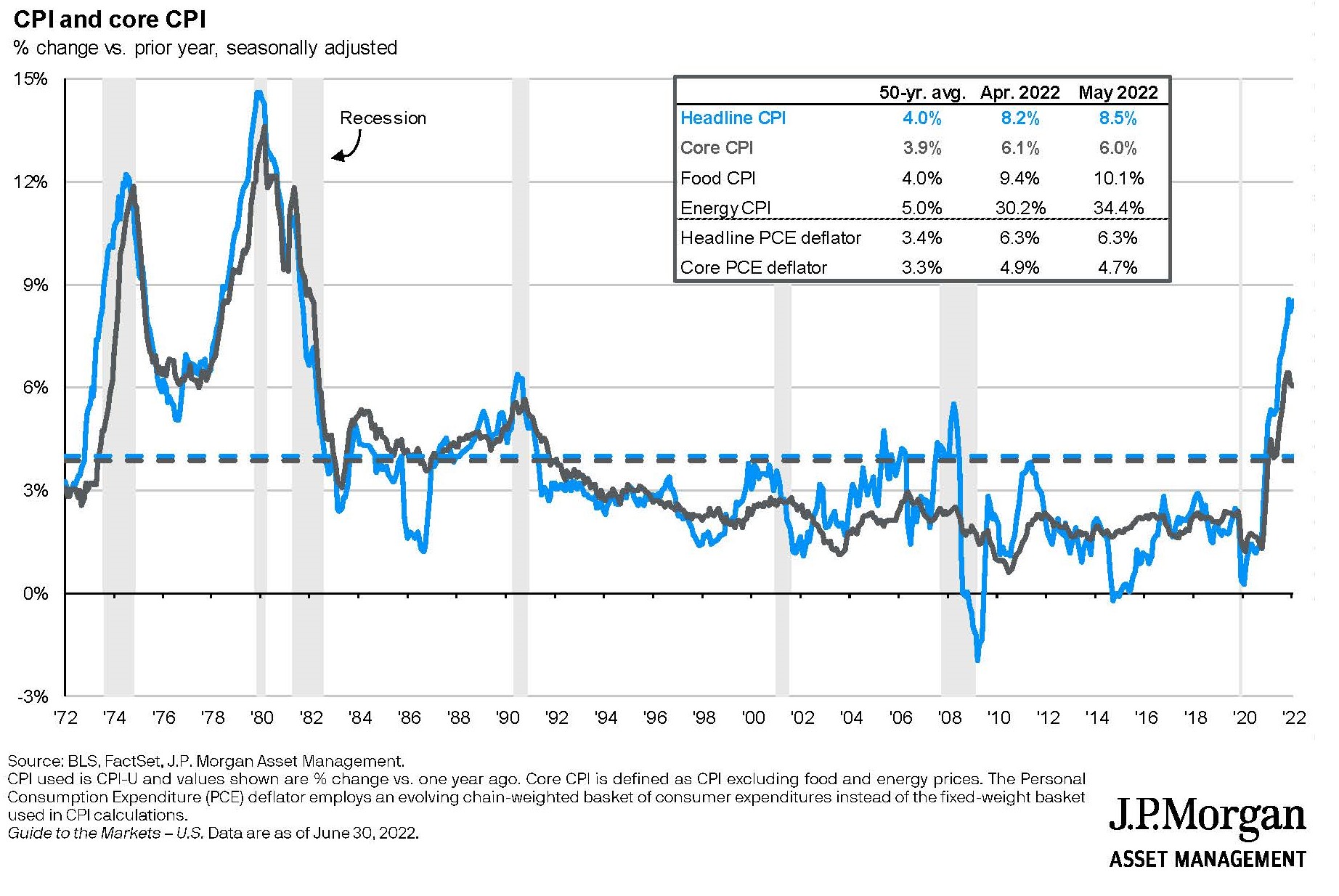

Inflation saw its largest year-over-year gain in over 40 years and surged to over 8.5% during the quarter as higher rent, gas, and food prices made it harder to afford everyday staples. This gain was led by May’s gargantuan increase in energy inflation of over 34%. Unlike most periods where higher inflation was caused by excess demand, we are seeing supply-related inflation pressures this time around largely due to supply-chain bottlenecks related to COVID-associated shutdowns. While these bottlenecks seem to be normalizing, they are complex in nature and continue to be a challenge for most companies.

The conflict in Ukraine also is contributing to higher inflation. Gas prices are higher because of restrictions on imports of Russian oil, and food prices are affected because Russia and Ukraine are major exporters of commodities like wheat and sunflower oil.

The Fed Reacts

The Federal Reserve has been raising the Fed Funds rate, hoping that higher rates will slow demand growth, and ultimately rein in inflation. Although the supply pressures are dominant in driving inflation right now, the Fed’s action on cooling off demand to bring supply and demand more into balance is another way to combat aggressive inflation. The Fed increased the Fed Funds rate by 50 basis points (bps) in May, its largest rate increase since 2000. This was followed up with another 75bps increase in June. Including the 25bps hike during the first quarter, the Fed has increased rates 1.5% so far in 2022 and more rate increases are anticipated.

Investment Outlook

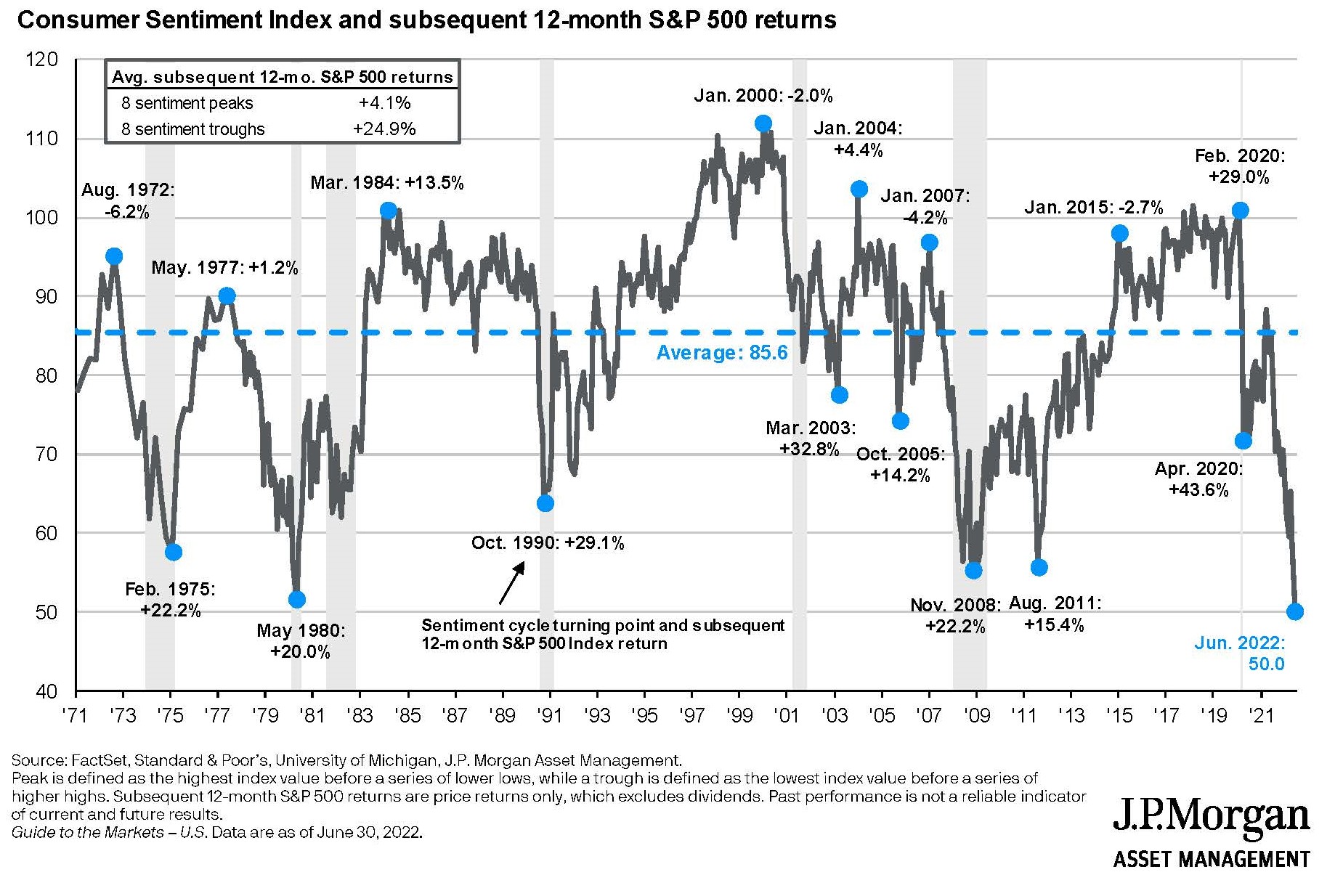

Investor sentiment has soured to deeply contrarian levels and many are predicting a recession in the near future. As illustrated in the chart below, consumer sentiment is lower than it has been in the last 40 years, even lower than it was during the financial crisis or at any time during the pandemic.

Given the pervasive negative sentiment, our optimistic outlook is clearly in the minority. The stock and bond markets have priced in rising interest rates and a slower economy. With an investment horizon of one year or longer, we believe this is an attractive time to be buying.

Consumers are still strong, supported by high cash balances and a tight labor market with solid wage growth. Corporate balance sheets remain strong amid robust demand and are able to offset higher operating costs through strong pricing power. Corporate earnings have continued to grow during the recent market decline and are expected to continue growing through the end of the year. While we anticipate that these forward-looking estimates may be reduced, we continue to believe corporate earnings growth will persist.

Famed value-investor Warren Buffett coined the phrase “be fearful when others are greedy and greedy when others are fearful.” We think the recent market selloff has created an attractive long-term buying opportunity and we are reviewing client portfolio allocations and modestly shifting capital from cash to riskier assets to take advantage of attractive valuations and negative investor sentiment.

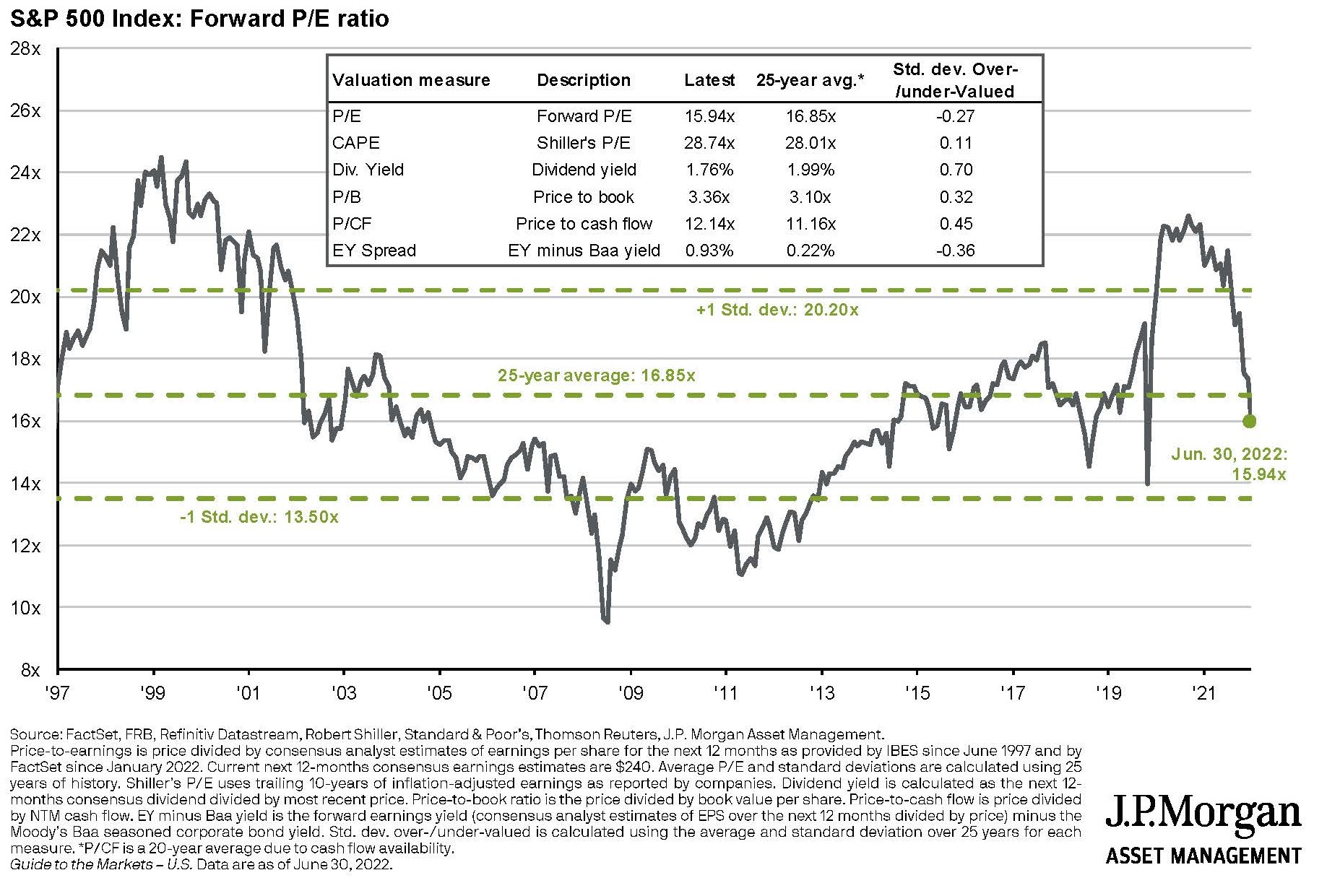

We recently exited most of our gold investments. In the coming months, we also may reduce or eliminate our commodity related and inverse interest rate investments and shift high cash balances into higher yielding bond investments. In conjunction with this, we are likely to incrementally increase equity exposure in client accounts where it makes sense because equity valuations are very attractive and below their 25-year average, as seen in the chart below. Specifically within equities, we have shifted some of our exposure toward small, mid, and large cap value and away from large cap tech stocks (growth stocks), which are generally more expensive than the rest of the market.

While investing during uncertain times can be unsettling, it is important to keep a long-term view and understand that market volatility can create attractive buying opportunities.

6/30/2022

Graphics source: JP Morgan Asset Management, 6/30/2022, unless noted otherwise.