Q2:2023 Investment Commentary

Stock Performance Defies Skeptics

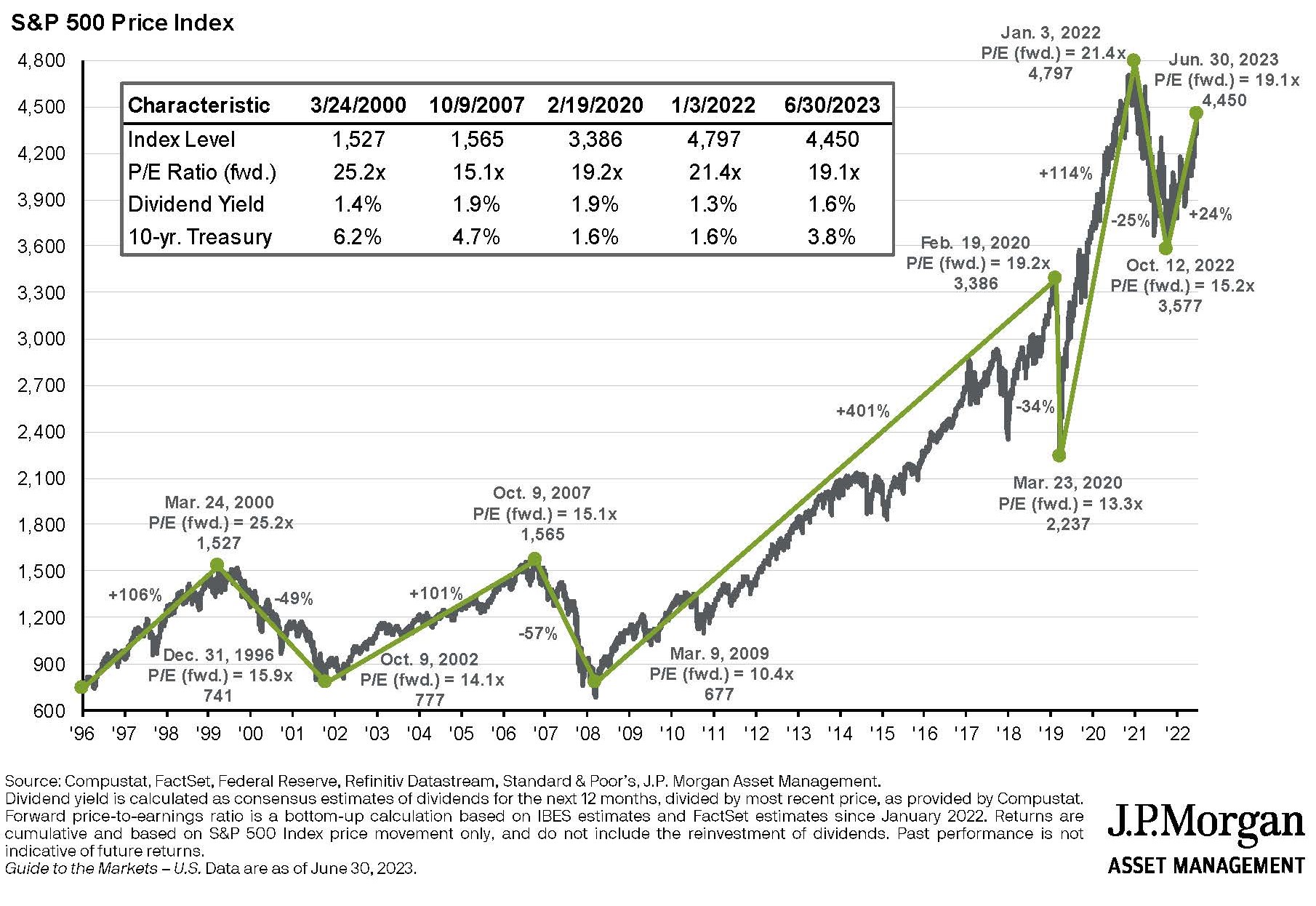

Despite continued warnings from skeptics anticipating an economic slowdown, the equity market posted another strong quarter in Q2 with the S&P 500 rising 4.0%. This brings the 2023 year-to-date increase to nearly 17%, reversing much of the early 2022 stock market declines.

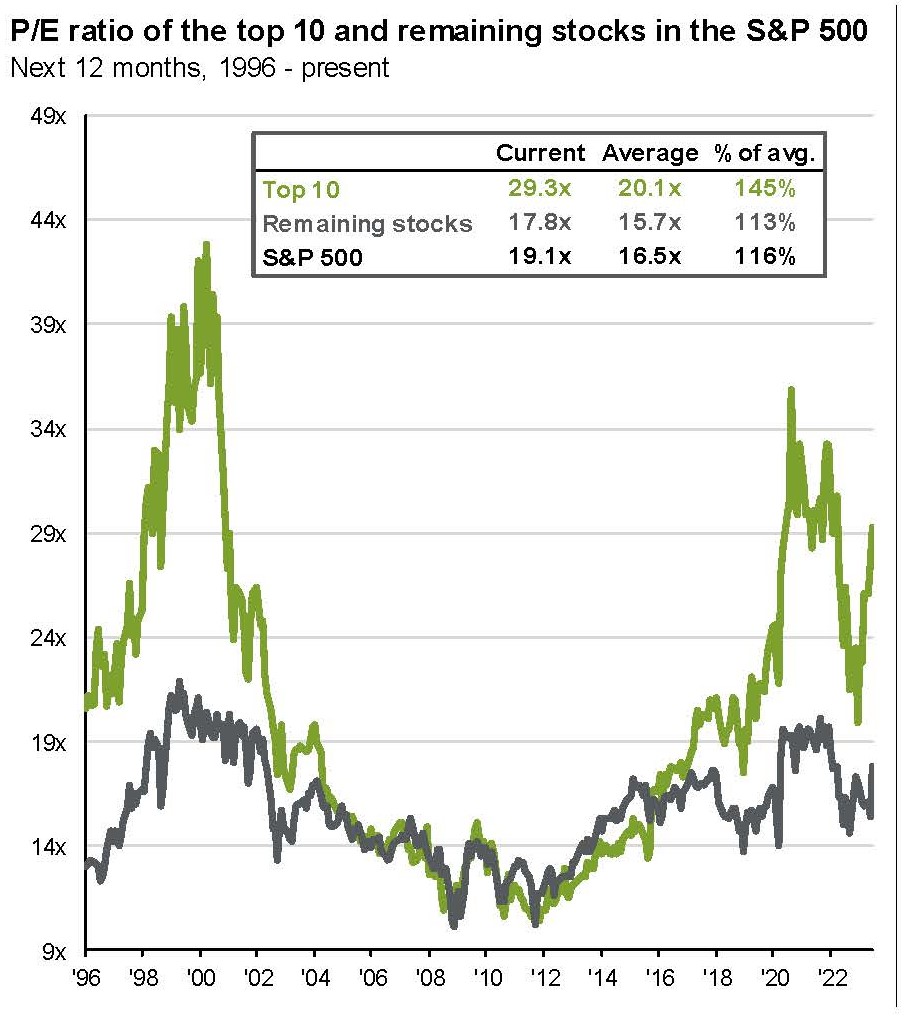

Leadership of the rally comes from large technology companies, particularly with those in the growing Artificial Intelligence (AI) business. The graph below illustrates the impact that the largest 10 stocks have on the S&P 500. These 10 stocks (AAPL, MSFT, AMZN, NVDA, GOOGL, TSLA, GOOG, META, BRK.B, and UNH) have significantly higher average valuations than the other 490. Toward the end of the quarter, market momentum broadened to include more companies across industries.

Highlights From Q2

Perhaps what has made the recent rally so surprising has been the persistence of geopolitical and economic red flags. The Russia-Ukraine conflict continues. The Fed continues to raise interest rates as home prices decline. Office space remains much emptier than before the pandemic, especially in urban areas like New York City, where vacancies hit 22%.

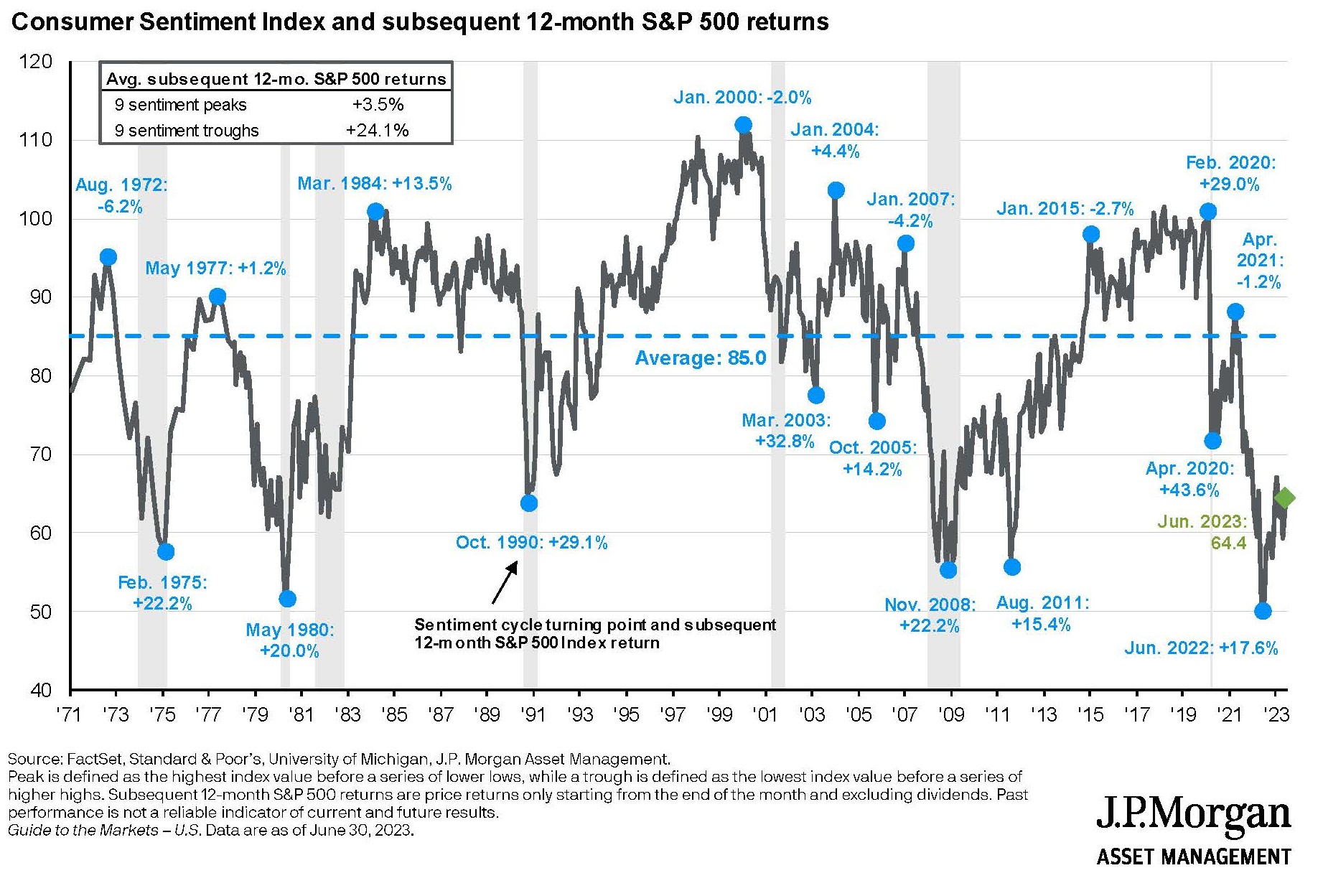

The economic statistic that best captures these concerns is consumer confidence, which remains near record lows of the past 50 years. Some may blame this lack of confidence on the media’s love for reporting bad news, social media, or the tendency for the political party out of power to frame issues negatively.

For whatever reason, encouraging signs seem to get ignored. Employment remains strong, which supports consumer spending. Higher bond yields and stock market gains are pushing the net worth of many individuals toward record levels. Rather than a recession, 2023 is heading toward 2%+ GDP growth. These may not be the best of times, but they’re not all that bad either.

If you are having trouble wrapping your head around the contradictions between gloomy expectations and rosy outcomes, consider this: Many economic surveys – like consumer confidence – are collected across the economic spectrum, while rising investment returns accrue primarily in the wealthiest decile of the population. The average consumer may not share the rosy outlooks of the wealthiest Americans, which may explain continued caution.

It is the discretionary spending of the relatively wealthy group of consumers that is driving consumption growth. A recent McKinsey survey revealed that 41% of respondents intended to splurge in 2023. Top categories for spending included restaurants, groceries, travel, and apparel.

Bottom line: While the average consumer may continue to be cautious, low unemployment and affluent consumer’s spending on fitness, travel, and leisure may make recession concerns overblown.

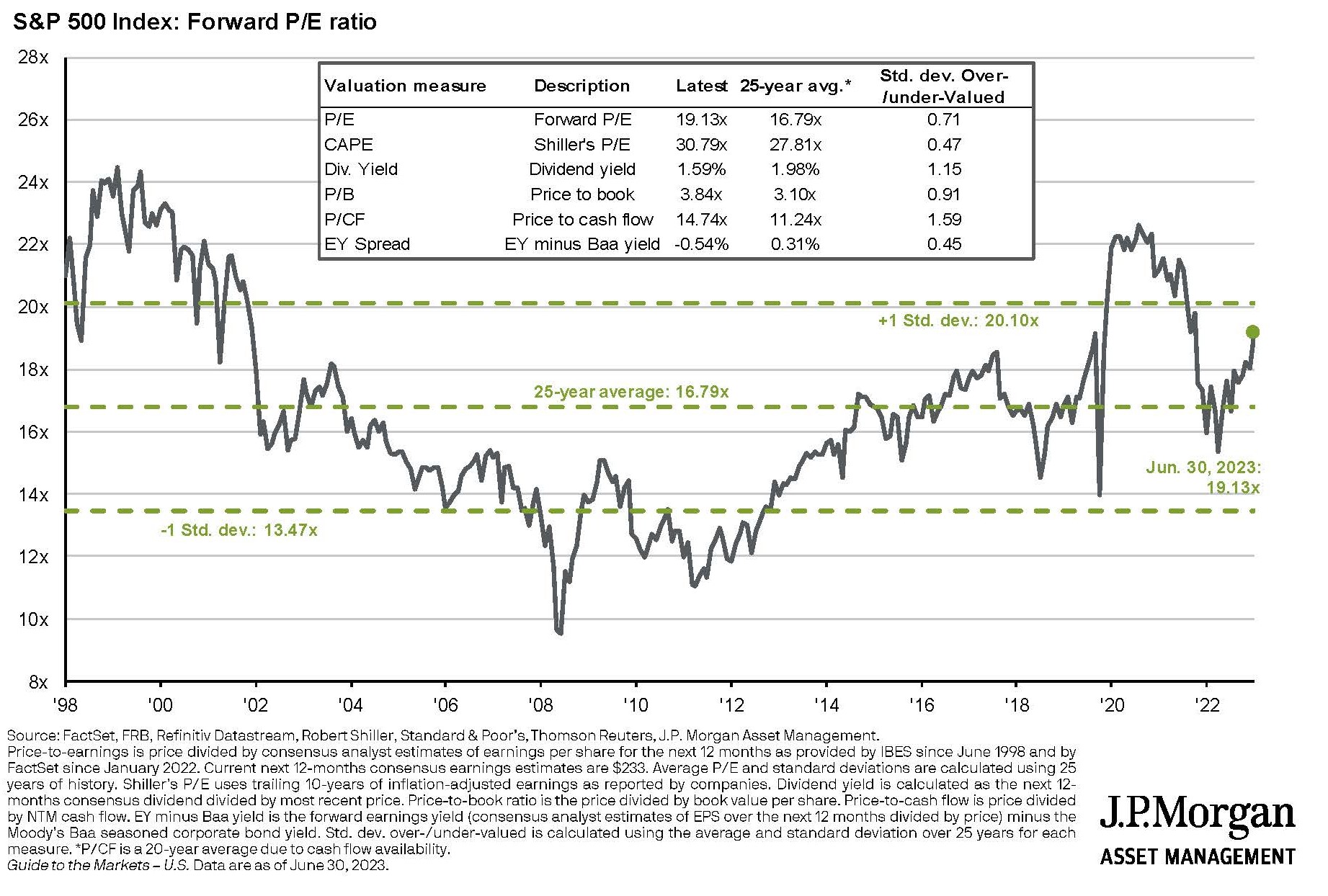

While this more sanguine outlook may be a relief to some anxious investors, there is a downside. Since there has been no hard landing recession nor a significant stock market decline, neither the economy nor the stock market is poised for a strong rebound. The S&P 500 is up 16% through mid-year and valuations are approaching 20x P/E; the best of 2023 performance may be behind us already.

During the depths of the 2008 Financial Crisis, Warren Buffett famously said, “A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful.” The surprise stock market rally is a reminder that cautious investors may miss out on stock market appreciation.

Investment Outlook

Conifer Bay Capital portfolios are fully invested, which is a technical way of saying that for clients with a 70% stock market target, 70% is invested in stocks. This is a position we have held since the middle of Q4 2022.

During the past six months, we have migrated investments away from smaller companies and value-leaning companies. These, we believed, would outperform in a slow-growth or no-growth economic environment such as much of 2022. Today we hold relatively more large-cap and growth companies.

The fixed income portion of our clients’ portfolios remains a bit of a riddle as we anticipate the Fed will keep raising rates, like the quarter point on July 26. The absolute level of yields looks incredibly attractive – relative to the past decade. With money market funds and corporate bonds under 10 years yielding 5% or more, investors should be adding to bond holdings.

While in some portfolios we continue to hold substantial cash and short-term corporate bonds, we are inching our way along the yield curve. Over time we may own more 5- and 10-year bonds.

One of the cheapest equity sectors remains emerging market stocks because of the concerns surrounding China: slowing economic growth, geopolitical risk, and East-West trade barriers. Although we believe that China represents a terrific investment opportunity at current price levels, we are unsure of whether investors will be rewarded in the next year or not for 10 more. Therefore, we are maintaining our aggregate emerging market exposure at relatively low levels.

It may be difficult for investors to recall that at this point in 2022 the S&P 500 was down 20% as investors worried about the Russia-Ukraine conflict, high energy prices, 9% inflation, 0.75% jumps in the Fed Funds rate, and a leaked Supreme Court reversal of Roe v Wade. We hope every reader takes a moment to take a deep breath and be thankful for the relative calm that the stock and bond market now enjoy!

6/30/2023

Graphics source: JP Morgan Asset Management, 6/30/2023.