Q3:2022 Investment Commentary

Historic Declines in Stocks and Bonds

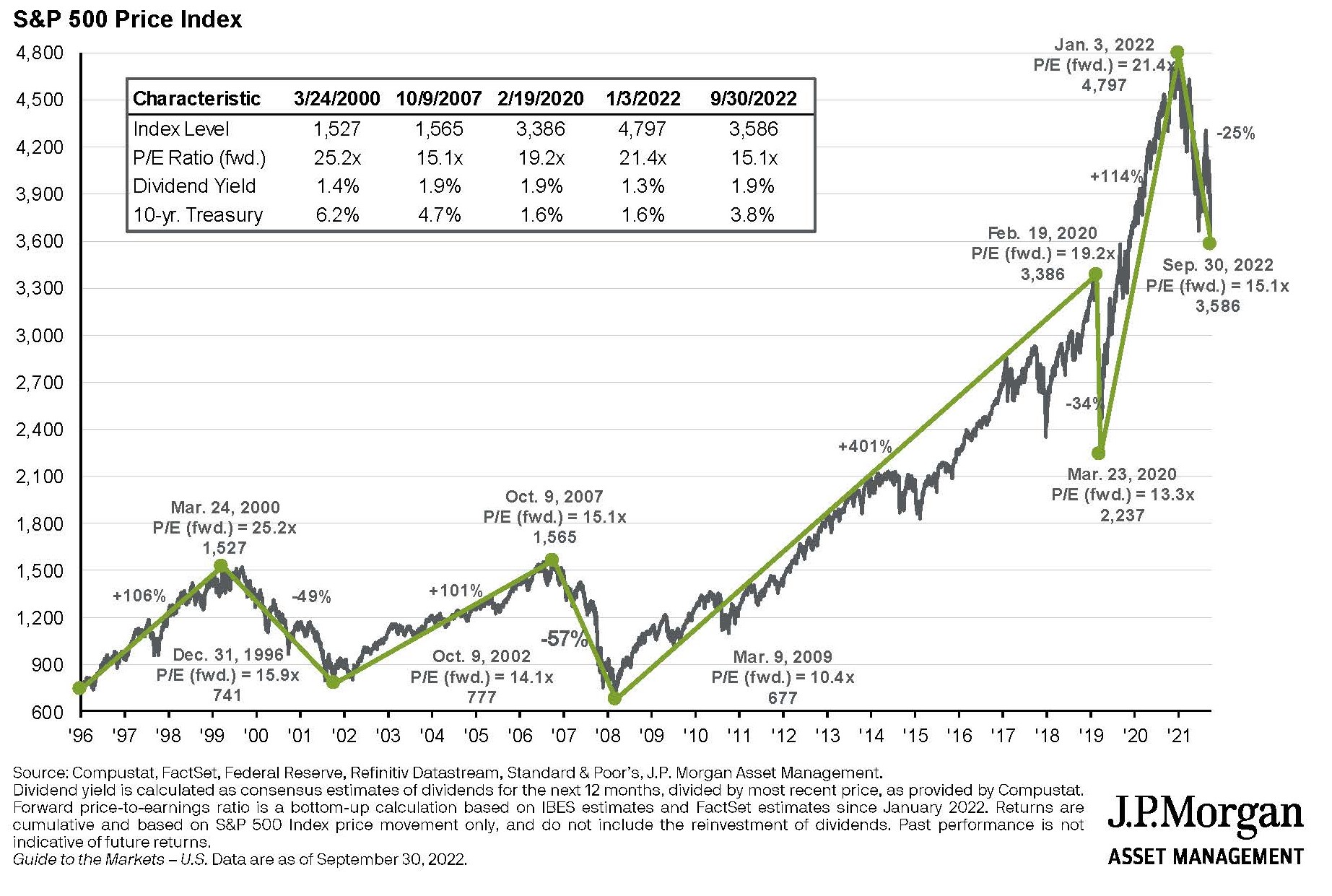

The third quarter of 2022 saw financial markets continue their year-to-date decline, with the S&P 500 falling 4.9%, its third consecutive quarter of declines. Year-to-date the market is down 24.9%, eliminating nearly all of the prior year’s 28.7% gain.

This is a particularly painful year for investors as nearly every asset class is in decline. Foreign equities, emerging market equities, and even fixed income are all experiencing significant losses.

Dismal Year for Bonds

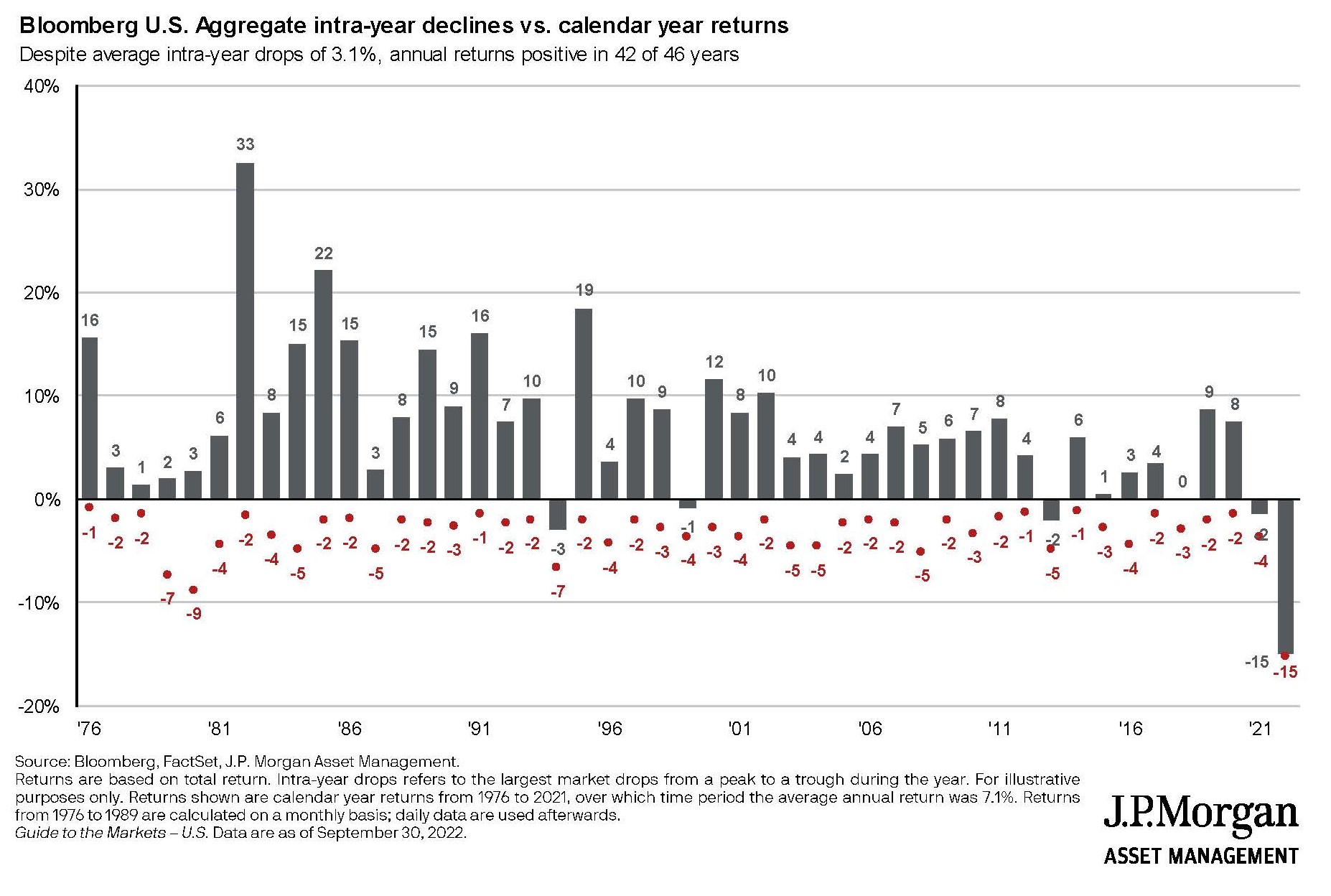

In response to the Federal Reserve’s aggressive policy changes, bond yields have increased to the highest levels in a decade while bond prices have declined. The Bloomberg U.S. Aggregate Bond Index has declined by 15% thus far in 2022, in sharp contrast to performance during the low but positive returns through the Fed tightening cycle in 2016-2019.

Since 1976, the single worst year for the bond market was -3% in 1994. The -15% through three quarters makes this year a monumental outlier.

Ulcer-Inducing Volatility

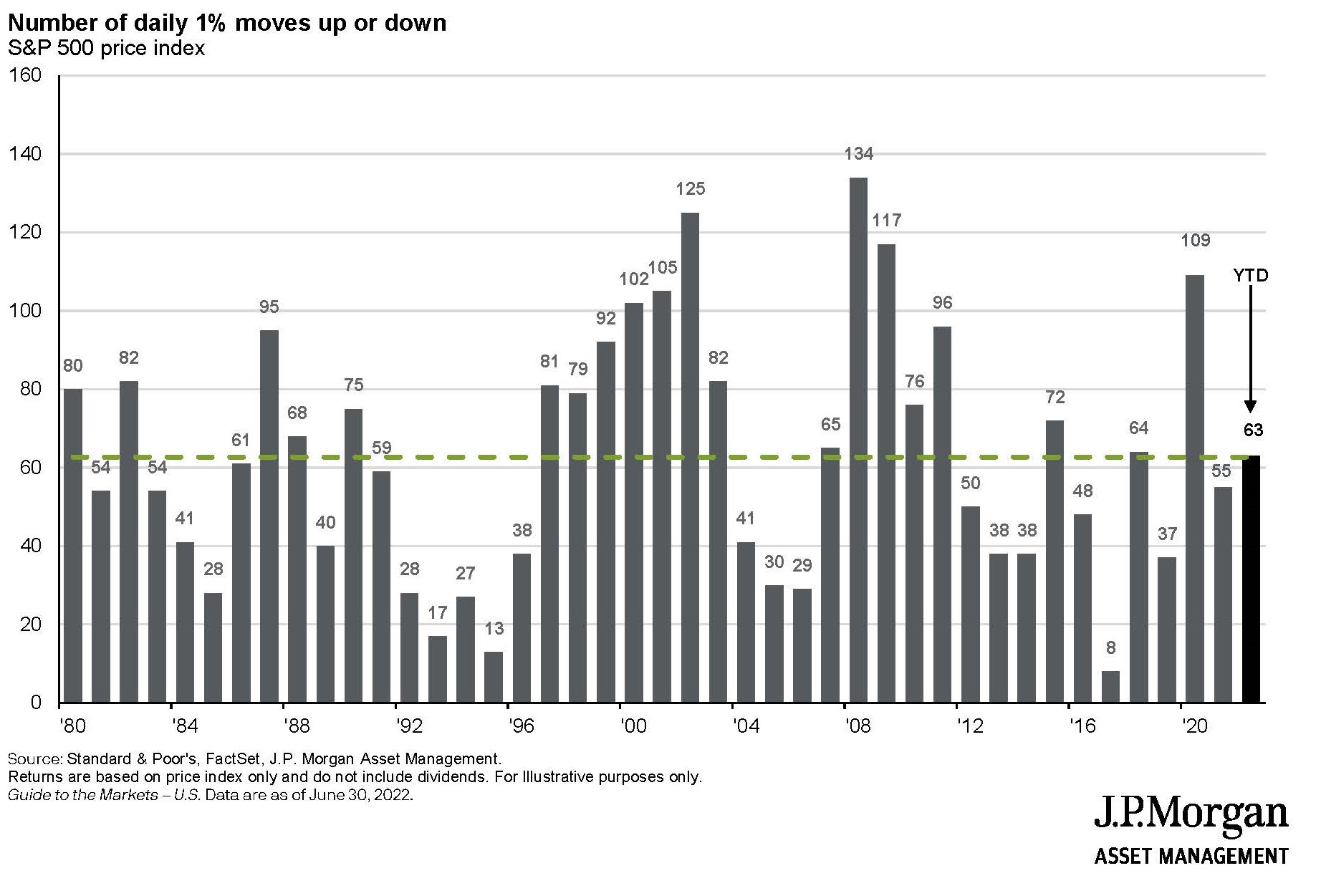

If your gut (and the evening news) tells you that the markets are more volatile than before, trust it. They are!

One handy measure of daily market swings is the number of >1% moves up or down in the S&P 500. Since 1980, in an average year of 260 trading days, there are about sixty >1% daily moves. In 2022 we experienced this many volatile days during the first half of the year. Although not shown in the chart below, we saw 83 such days through the end of the third quarter.

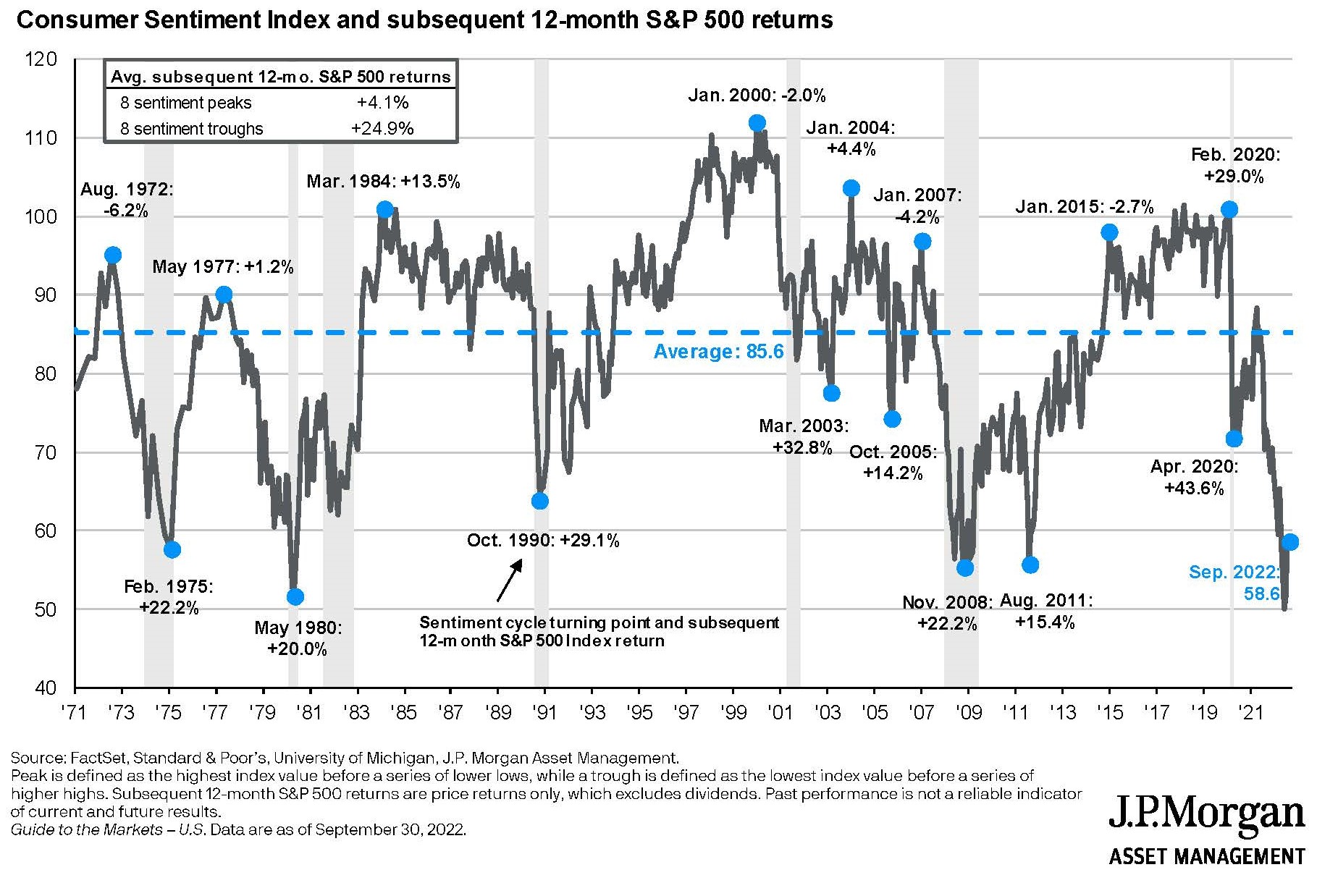

No surprise, the market volatility and declines have taken a toll on investor sentiment, especially following years of steady double-digit returns.

Long-term investors must remember that the seeds of future great returns are sown during bear markets, which since 1929 have lasted an average of 20 months. This pales in comparison to the duration of bull markets during this period, which have lasted an average of 51 months.

Bond investors, who have suffered under near-zero bond market yields for nearly 15 years, finally are receiving interest on their capital!

Recession Forecast

The U.S. and the world may already be in an economic recession, with an uncertain duration and severity.

For many Americans, the labor market and consumer demand remain strong, which does not indicate a market on the precipice of entering a long or deep recession. The balance sheets of U.S. consumers and corporations remain solid as both continue to spend their way through these higher inflationary headwinds, contributing to economic growth. Compared globally, the economic landscape in the U.S. appears to be in the best shape.

Investment Outlook

In the immediate future, Conifer Bay Capital continues to anticipate higher levels of market volatility given the plethora of uncertainties today. These include the trajectory of inflation, the cadence and size of future Fed rate hikes, slowing global growth and possible recession (if we are not already in one), potential escalation of the Ukraine-Russia conflict, mid-term elections, and overall geopolitical instability.

Our typical investment portfolio holds fewer equities and more cash than normal. We consider this deviation from our long-term target to be temporary.

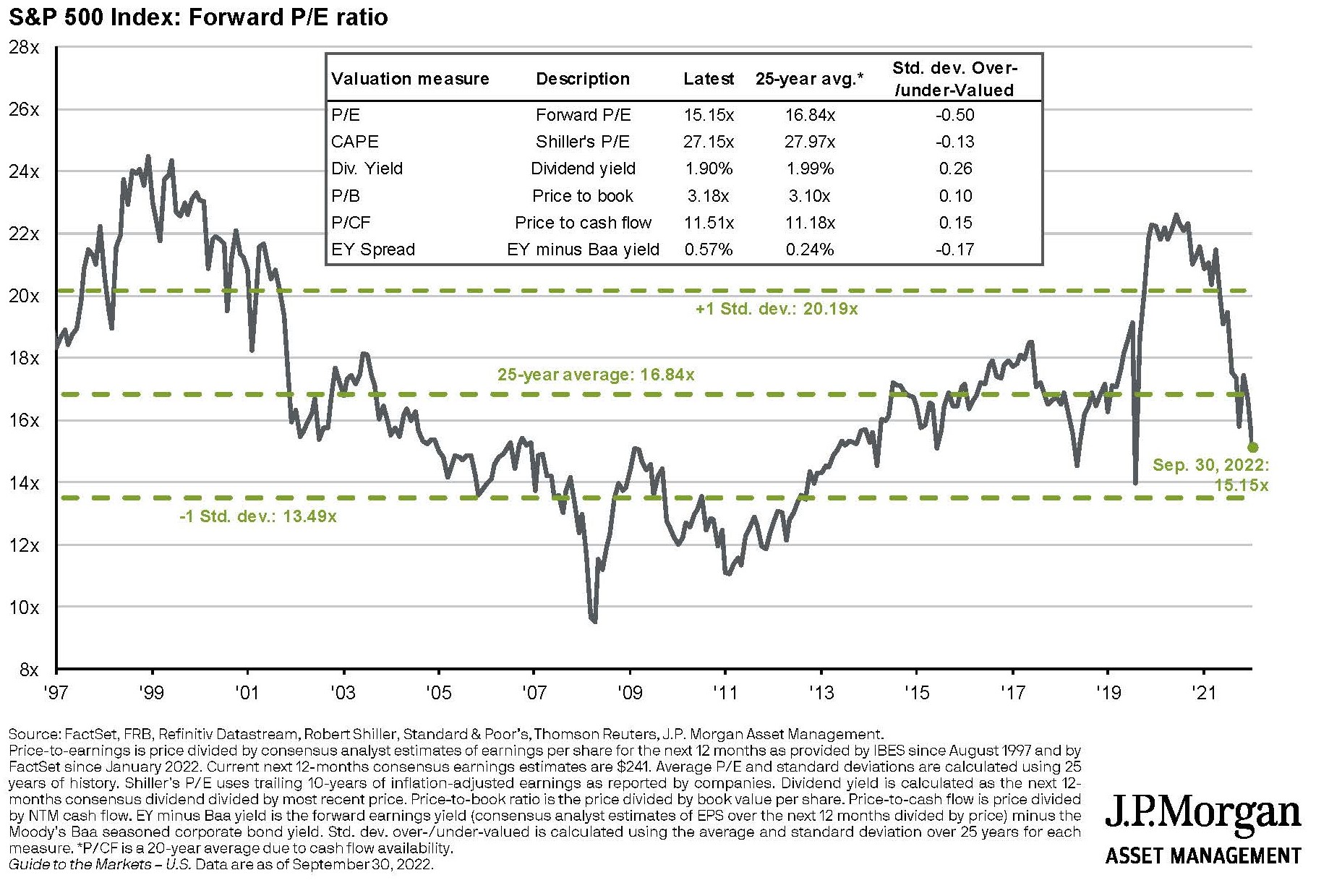

Current valuations in the stock market are below the 25-year average and approaching the lows of the 2008 Financial Crisis.

Given these attractive equity valuations and our view that the U.S. is the strongest region globally, we are considering modestly increasing exposure to U.S. equities.

While we currently have less exposure to foreign and emerging markets than in prior periods, we are considering increasing the weight in emerging markets due to the growth profile in these countries and the possibility of China broadly reopening from its strict Covid lockdowns.

Outside of equities, fixed income yields have improved dramatically over the course of the year, making fixed income investing more appealing. The yield on the 10-year Treasury, which started the year at 1.5%, has more than doubled to 3.8%. We are taking advantage of the increase in yields by investing the cash portion of client accounts into higher-yielding money market funds.

We will be diligently analyzing upcoming corporate earnings announcements. While earnings growth and profitability are impacted by the global macro economy, they are not identical. For example, while the U.S. economy may shrink, earnings for the companies we invest in may still grow, albeit at a slower rate than in prior years.

Although the Fed continues to fight inflation, we remain constructive on the financial markets because current earnings growth projections and the employment picture are a long way from recession territory. We understand that market volatility can be unnerving, especially given the recent declines, but it is important to keep a long-term view as this volatility often creates attractive opportunities.

9/30/2022

Graphics source: JP Morgan Asset Management, 9/30/2022, unless noted otherwise.