Q3:2023 Investment Commentary

STOCKS TAKE A BREATHER

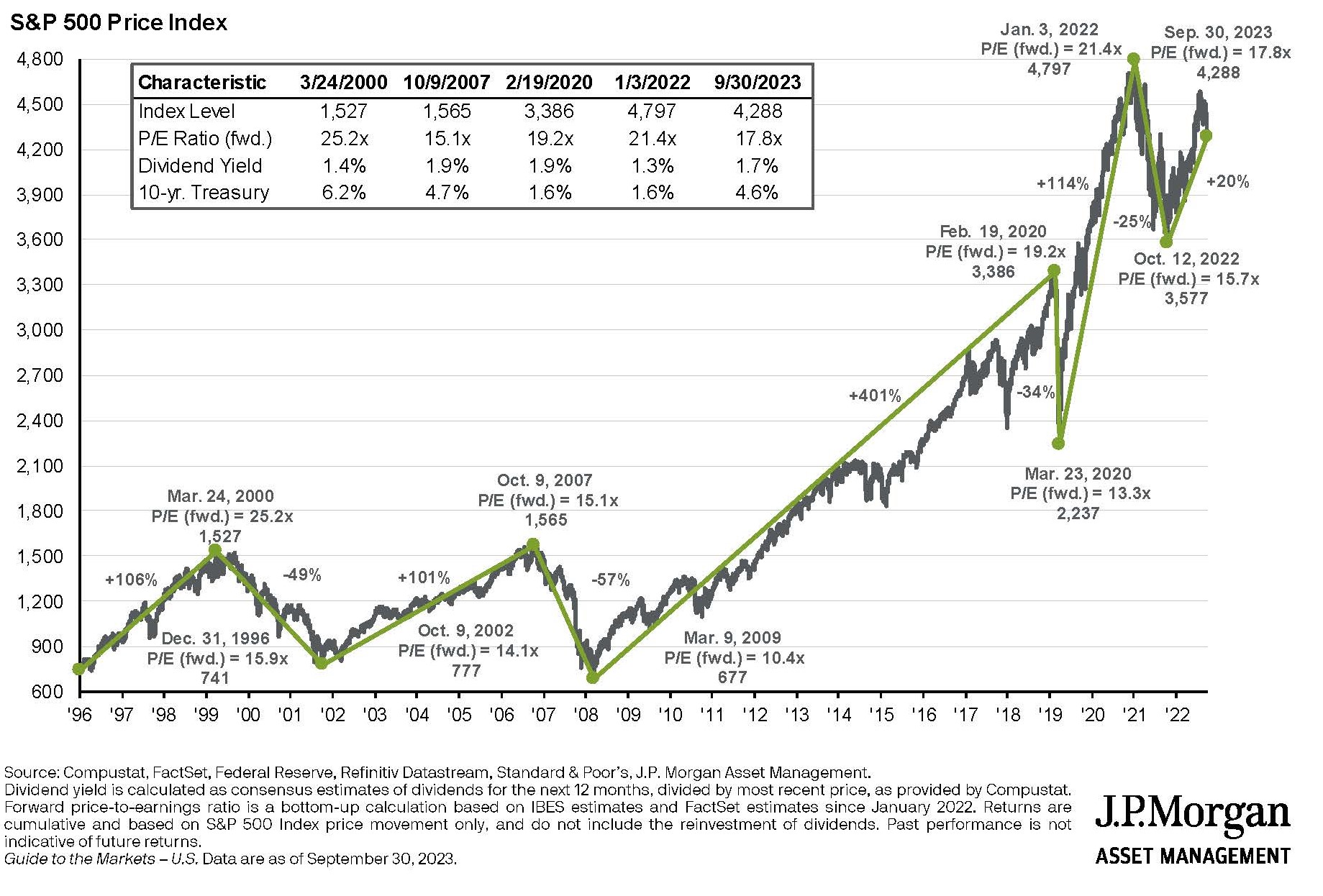

The upward trend in stock prices was broken in Q3 after rallying for the previous three consecutive quarters. Although the S&P 500 declined 3% during the July to September period, stocks are still up 13% year to date, with most of the gains concentrated in growth sectors including technology.

The small recent decline in stock prices did not surprise some investors, who may have sensed that stocks had appreciated too quickly earlier in the year. We wrote in our Q2 newsletter that the best returns of 2023 may have already occurred, and we still believe that.

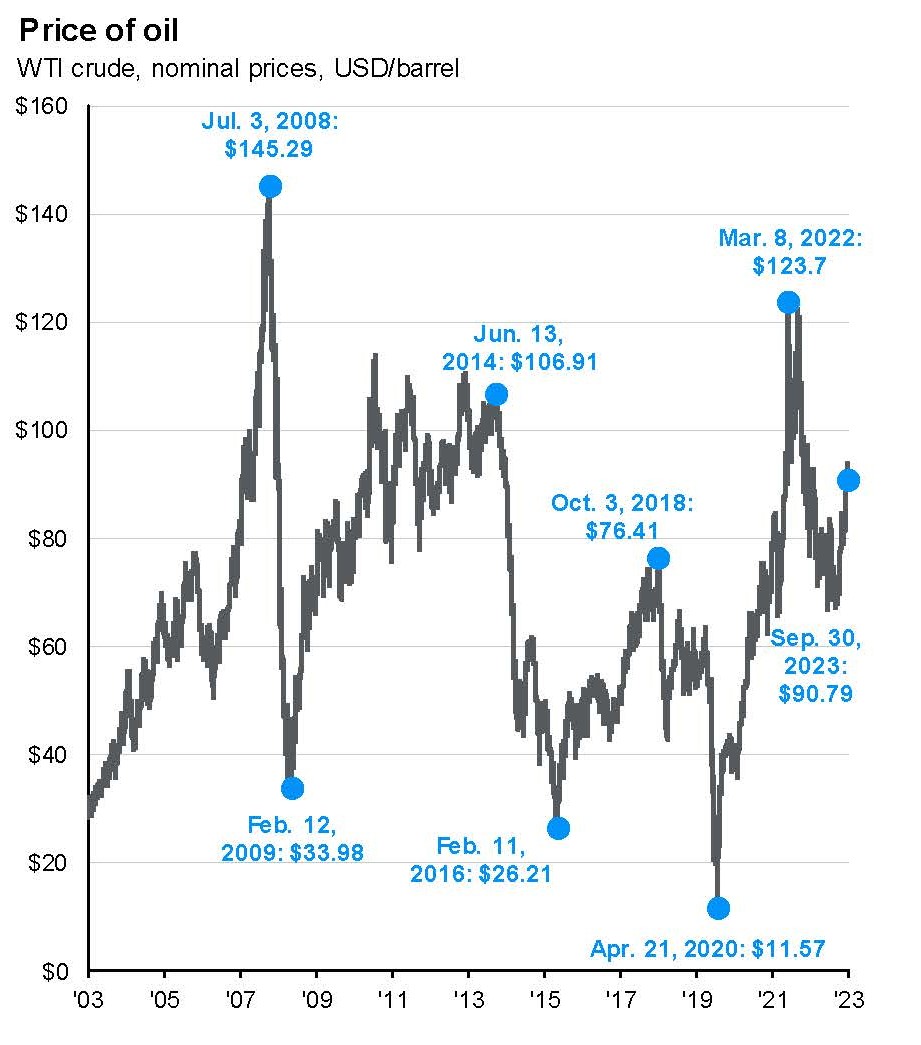

Other markets saw the same downward turn. U.S. small cap, value, foreign and emerging market stocks, and bonds all declined by small amounts. One clear exception was the energy sector. Oil and gas stocks in the S&P 500 rose 12% during the quarter, propelled by rising oil prices that were up more than 20% in one quarter.

Challenging Times for Economists: The financial world today seems divided into two camps. One camp believes stock prices are slipping because of an anticipated economic recession caused by the rapid rise in interest rates. The other believes stock prices will be driven higher by strong earnings and resilient consumer spending.

This situation is an excellent opportunity for economists to determine the most likely direction of the economy. Many have supported the recessionary camp, yet U.S. GDP has increased each quarter of 2023. The recent Q3 announcement was that economic activity increased at a 4.9% annualized rate. Many are still calling for a recession soon.

Let’s be fair to the economists: They have tough jobs. Analyzing business conditions and forecasting the future is uncertain at best. Perhaps there is truth to the joke: Why did God create economists? To make weather forecasters look good.

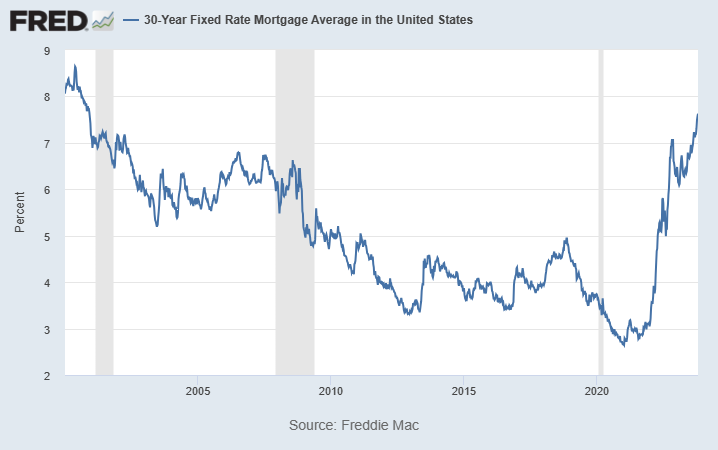

Today we are firmly surrounded by an environment of mixed economic signals, which makes predicting the future especially difficult. For example, interest rates are high. This is great news for retirees who live off the income of bond portfolios with current fund yields of over 5%. But higher interest rates are terrible news for people who need a mortgage. Borrowing rates on 30-year mortgages of more than 7.5% are at highs not seen in 20 years.

These high mortgage rates impact the housing market in two ways: Buyers may not be able to afford the higher interest cost (demand impact) and current homeowners do not want to give up the low interest rates they locked in just a few years ago (supply impact).

Higher interest rates have a positive impact on people saving money but a negative impact on borrowers (e.g., home buyers), an example that illustrates the difficulty of making economic predictions for the global economy.

Other Mixed Economic Signals: The labor market is another economic sector experiencing mixed signals. Monthly employment data show that the job market is cooling, yet unemployment remains near record lows. Meanwhile short-term factors including labor strikes in the film and auto industries, and another possible government shutdown continue to cloud the labor outlook.

Uncertainty also exists in geopolitics (Russia-Ukraine, U.S.-China, Israel-Hamas) and in federal politics (Speaker of the House turmoil, and an upcoming presidential election cycle).

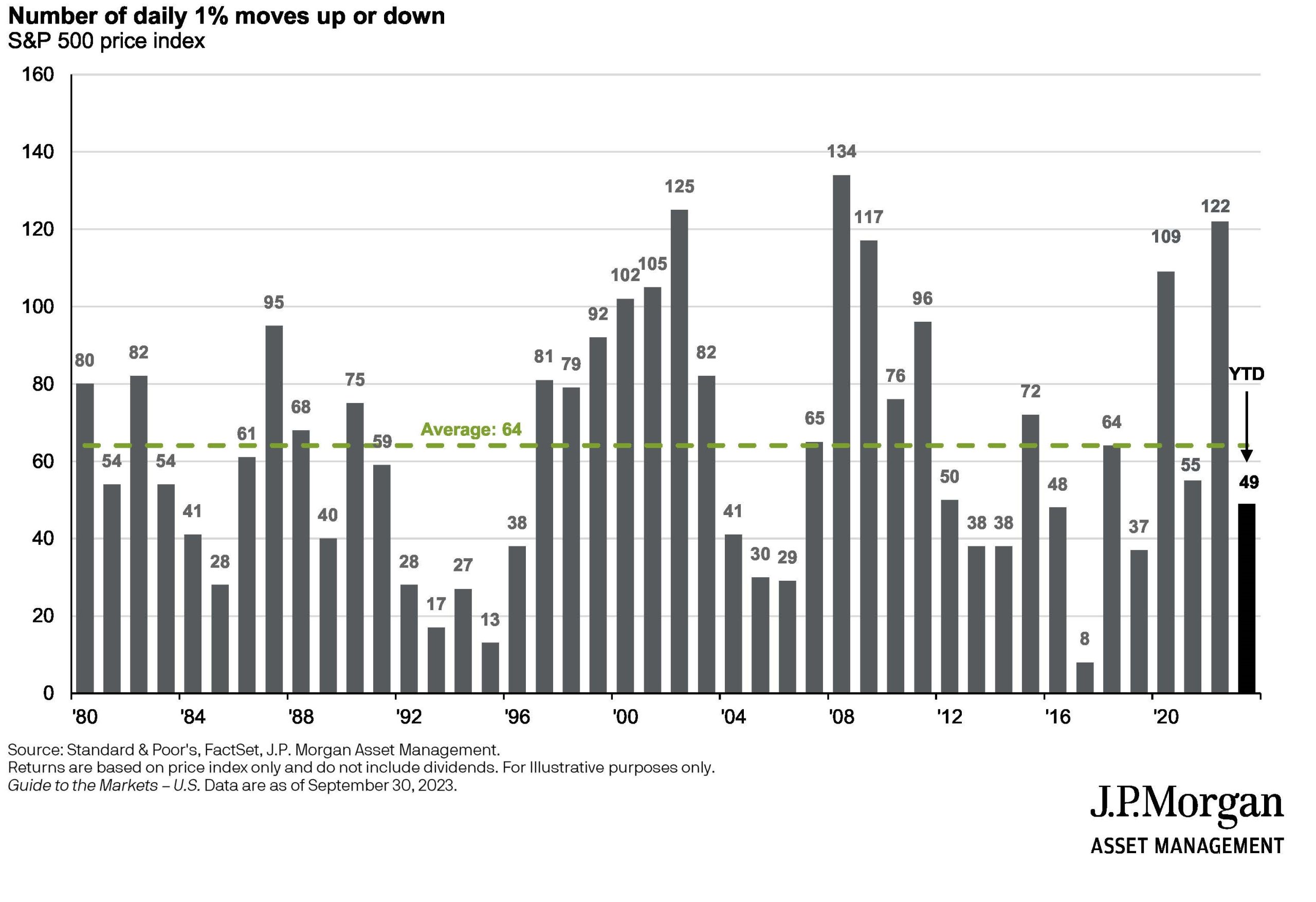

So many unknowns may prompt the stock market to become more volatile but thus far 2023 has been only slightly more volatile than the typical year. One measure of stock market volatility is simply the number of days each year that the stock market goes up or down by at least 1%. The average year has 64 of these volatile days. Thus far in 2023, we are on pace for roughly 67.

How Should Individuals Think About Investing When Uncertainty Is High? Pragmatically. Diversification is even more important during periods of uncertainty, and investors should be ready to make targeted portfolio adjustments as the investment environment changes.

Worry less about having cash in exactly the right assets. Pay more attention to being directionally correct. Good questions to consider: What did my portfolio look like last month? What’s changed since then? Based on those changes, where should I be shifting my investments now?

Making frequent small, pragmatic adjustments may help navigate uncertain environments, especially when each day seems to highlight new twists and turns to the stock market.

DRIVERS OF FUTURE STOCK MARKET GAINS

To date in 2023 the best performing sectors of the U.S. stock market are three traditional growth sectors, Communication Services (+40%), Technology (+35%), and Consumer Discretionary (+27%). Enthusiasm about Artificial Intelligence (AI) has driven the gains and may be as important to future profitability today as the Internet was during the dot-com era in 2000.

Microsoft, Google, Broadcom, and others are leading the innovation around AI, but most companies are evaluating how AI will affect their business or industry.

Although the market has rewarded some companies that are at the cutting edge of AI adoption, there are stratospheric expectations for results from these few. We believe this latest technology revolution will be as prevalent as cloud computing and digital technologies have become. However, these are the early stages of AI adoption and deserve a long-term investment perspective (5-10 years) as not everything will be flushed out within the next 12 months. Investors should exercise patience and remember the recent excitement around streaming technology in media and entertainment. While much capital was deployed to capture streaming subscribers, media companies are currently finding it more difficult today to earn a return on that capital.

Opportunities in Smaller Companies: We believe a better choice for the investment gains may come from small- and mid-cap companies, which to date have been left behind the larger companies in this year’s stock price increases. In many cases these smaller companies have significantly lower valuations.

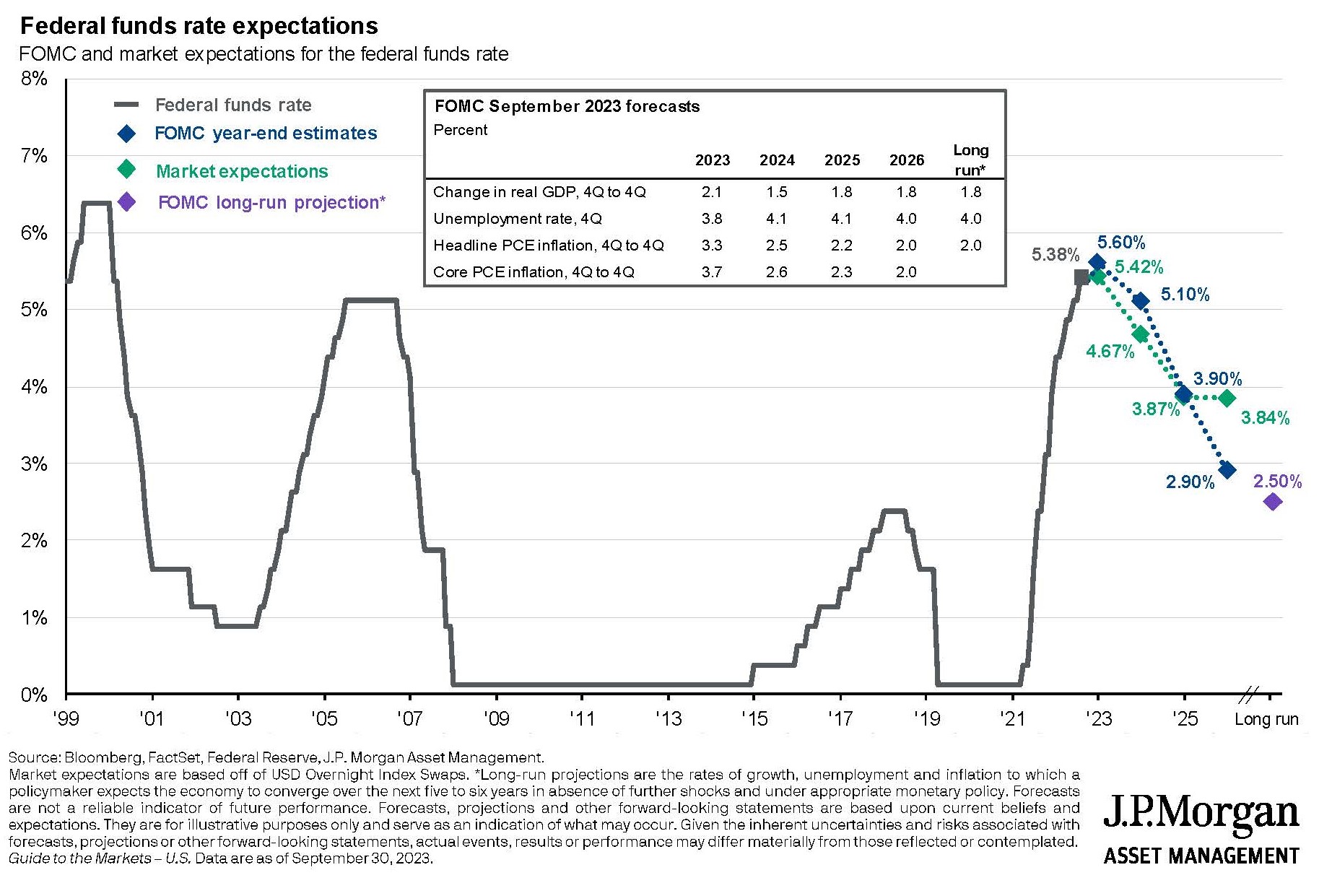

One important catalyst for a shift toward smaller companies could be a clear end to the Federal interest rate increases. Market expectations and Federal Reserve projections for future rates currently project as much as 2% rate cuts in the coming year or two. Among these smaller companies that might benefit from lower interest rates are regional banks, which profit more when short-term borrowing costs are lower.

INVESTMENT OUTLOOK

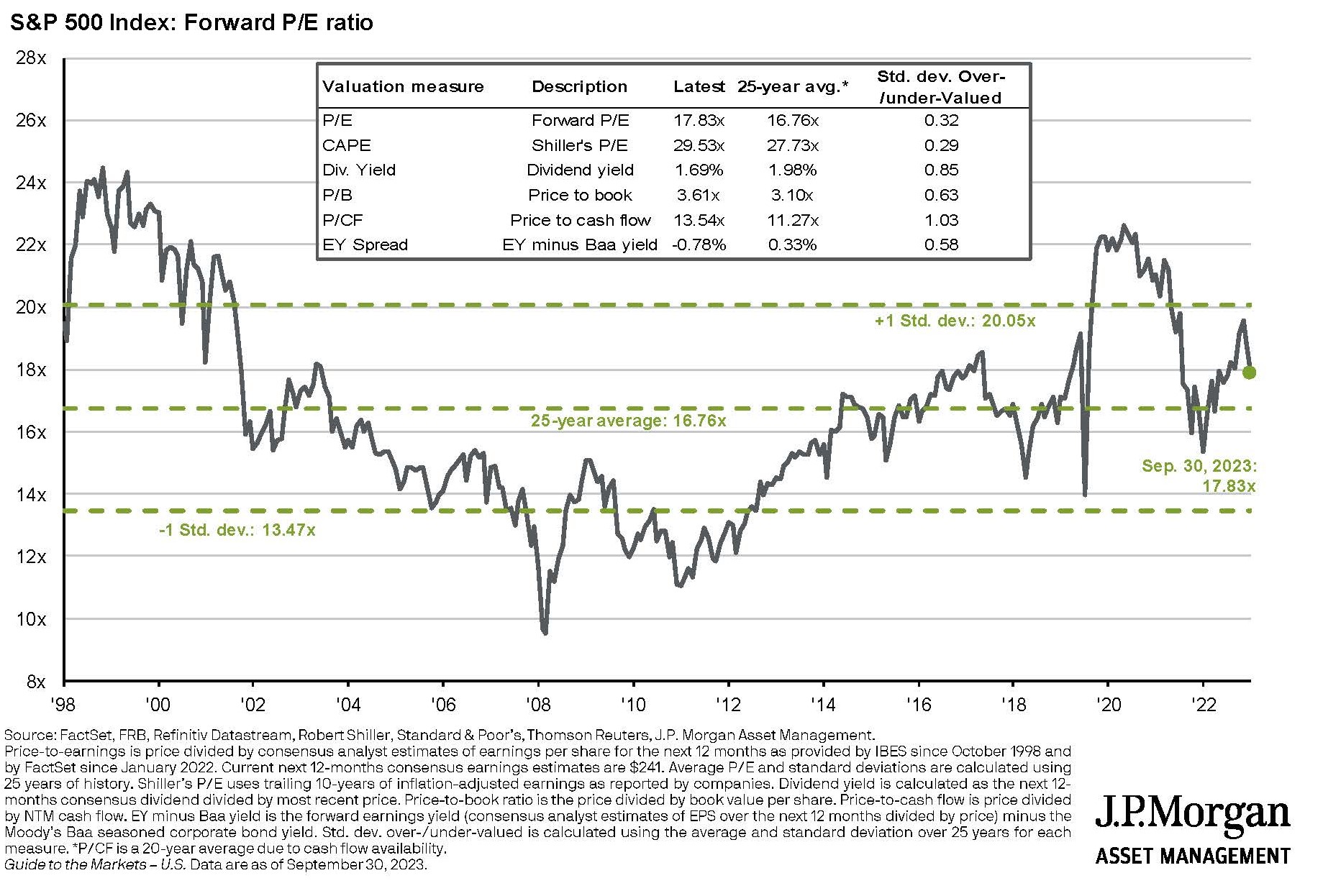

Overall we are quite enthusiastic about the investment opportunities ahead, although currently we are slightly defensive. Conifer Bay Capital portfolios are fully invested, which is a technical way of saying that clients with a 70% stock market target have 70% invested in stocks, but not more. This is a recommendation we have held for almost a year because valuations on U.S. stocks are relatively attractive as measured by the forward price-to-earnings (P/E) ratio.

Meanwhile, the fixed income market offers some of the best investment opportunities of the past decade. While the Fed may raise rates by another 0.25%-0.50%, the current high yields are attractive. Plus if the Fed reduces rates in 2024, the return opportunity in the bond market could be unusually high. With money market funds and corporate bonds under 10 years yielding 5% or more, investors should be adding to bond holdings at these levels.

In many portfolios we continue to hold substantial cash and short-term corporate bonds. We anticipate using these assets to increase our equity holdings or purchase longer-maturity bonds. Over time we will likely own more bonds in the 5-year to 10-year segment of the yield curve.

9/30/2023

Graphics source: JP Morgan Asset Management, 9/30/2023 and Freddie Mac.