Q4:2022 Investment Commentary

Growing Optimism in 2023

Stocks ended 2022 on a positive note following three downright terrible quarters. The S&P 500 rose 7.6% in Q4, bringing the full-year return to -18.1%.

Investors should be encouraged by the recent performance because many of the issues that drove the declines during the first three quarters of the year remain. These include China’s handling of the COVID pandemic, the ongoing conflict in Ukraine, political gridlock in Washington, higher interest rates, inflation, and recession fears–all remain unresolved. Yet the specter of these concerns seems less scary as stock prices appear to have stabilized.

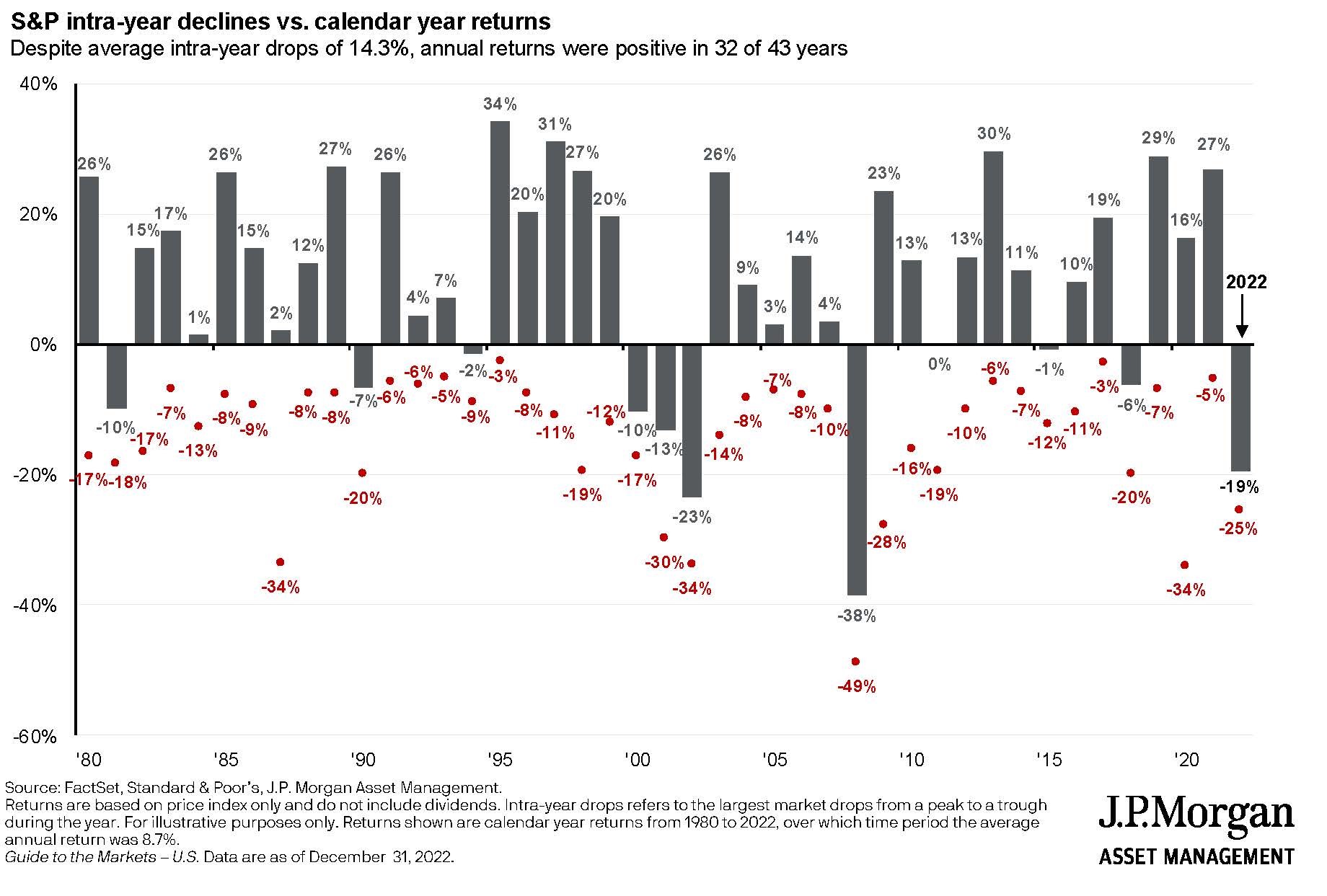

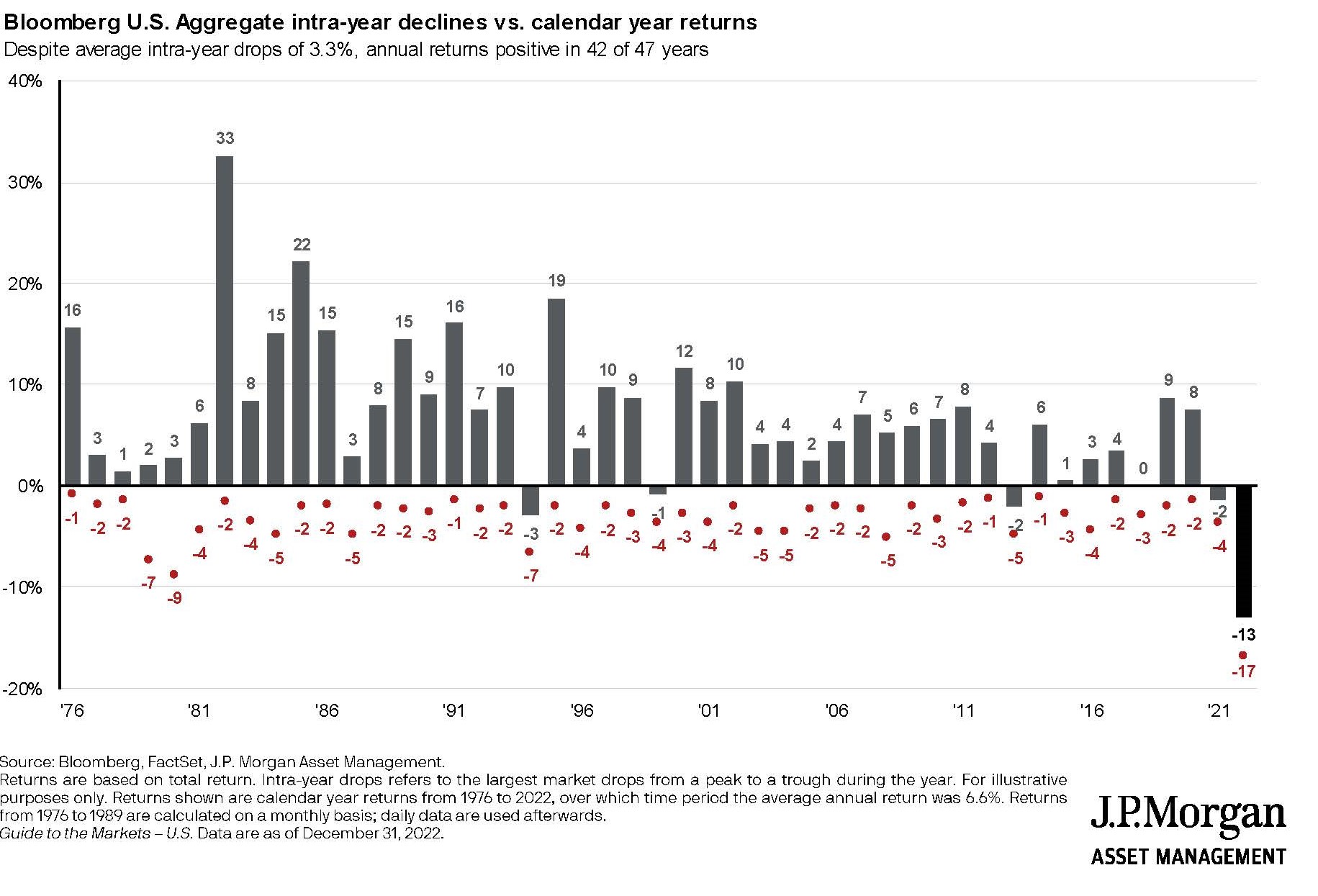

Reviewing the past 12 months, there is no sugar-coating it: 2022 was a very painful year for investors. The 18.1% loss for the S&P 500 was the 7th worst year since the 1920s. The -12.5% return for fixed income in 2022 was easily the worst year ever for the Bloomberg Aggregate Bond Index, which dates back to 1976.

Optimists will point out that the equity declines in 2022 came primarily from multiple compression, not from bankruptcies or lower earnings. This year investors will be focused on S&P 500 earnings estimates, which are currently projected to be about the same as in 2022.

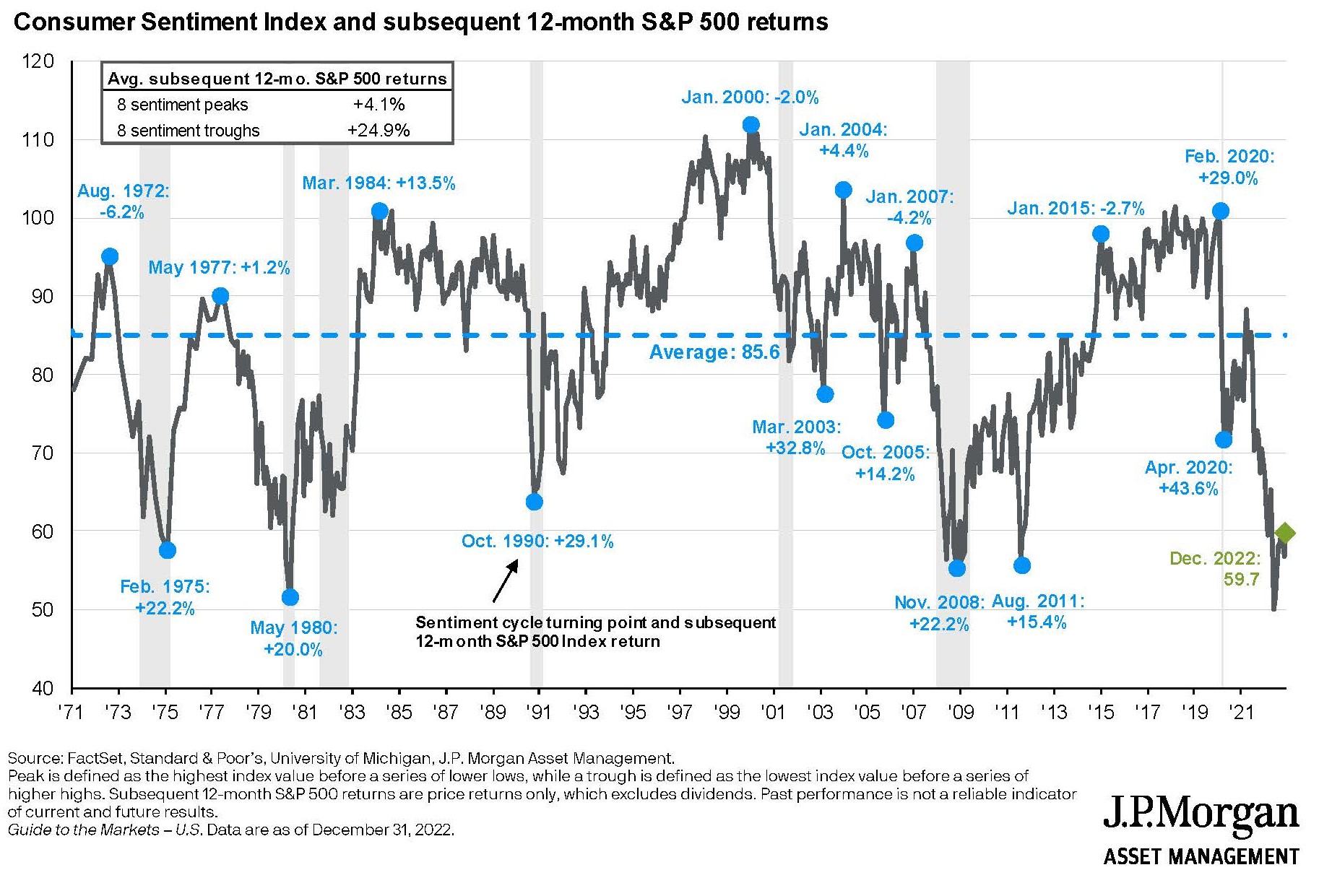

We believe the investment environment may be setting up for solid returns in 2023. Equity valuations and higher bond yields present some of the most attractive entry points in many years for investors, especially given the strongly negative sentiment in the market. Inflation appears to be receding, and the Fed’s tightening cycle could be nearing the end. Moreover, we believe that investors are unreasonably gloomy given the strength of the underlying economy.

Inflation Concerns Morph Into Recession Concerns

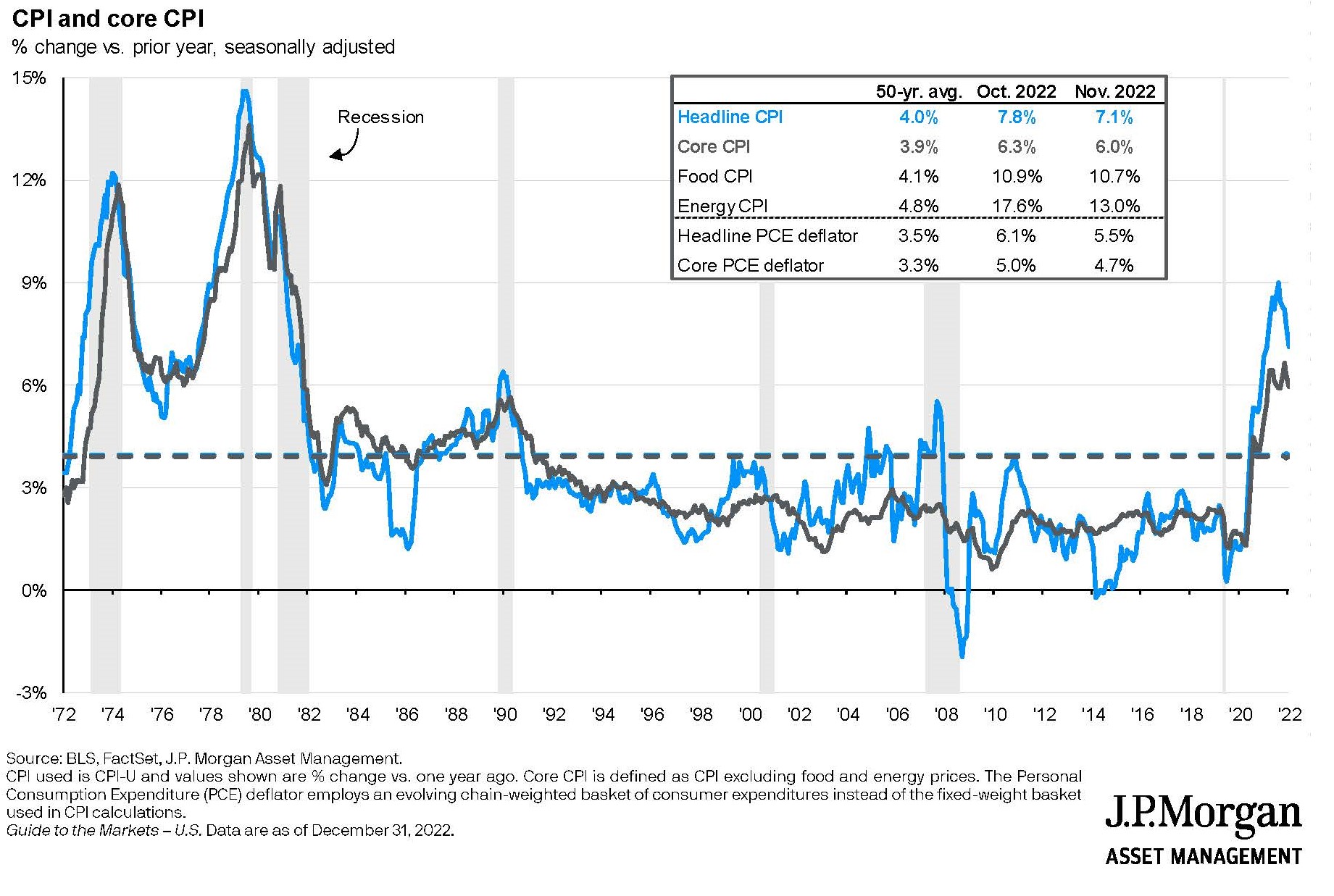

It appears that investors are transitioning from an intense focus on inflation to increasing concerns about a possible recession. We believe inflation, Fed rate hikes, and concerns about a possible recession are all inextricably linked. If the Fed believes inflation remains too high, it will continue to raise rates to stifle demand, thus slowing economic growth and bringing down inflation. If the Fed raises rates too fast, too high, or keeps them high for too long, this could lead to higher unemployment and negative GDP growth (among other things), ultimately pushing the economy into a recession.

The big question is whether inflation can head back toward the Fed’s target of 2% long-term inflation without a significant impact on the unemployment rate. The Fed’s dual mandate is full employment and stable prices. It does not want to overly sacrifice one (jobs) to reduce the other (inflation), but instead balance the two.

A surge in inflation to a four-decade high over the summer appears to be slowing, but apparently not fast enough for the Fed. The central bank worries that inflation will become entrenched in the economy unless it is brought under control soon. Given this, we anticipate further Fed tightening in the coming months. Will the Fed be able to thread the needle in fighting inflation while not stifling growth too much or contributing to a significant increase in unemployment? The answer may come this year.

Renewed Focus on Quality

Another shift we may be witnessing is declining investor interest in meme stocks and cryptocurrencies. Many of our peers and clients avoided investments in digital currency and NFTs (non-fungible tokens). Few found speculative meme stock investment ideas on Twitter or other social media platforms. Following the recent bankruptcy of the cryptocurrency exchange and crypto hedge fund FTX Trading Ltd., investors may be more cautious in the coming year, leading to a resurgence in “quality investing.”

By focusing on quality companies that are industry leaders with strong balance sheets and sustainable organic growth prospects, investors have the potential to lower their exposure to any broader equity market losses. We may be entering an era in which investors concentrate more attention on companies characterized by “fortress” balance sheets, strong fundamentals, solid return structures, and competitive strengths that afford companies pricing power.

[Note to readers: if this style of quality investing sounds easy, it’s not. Quality companies tend to have higher valuations and lots of small competitors vying to take market share.]

Outlook

We believe that the multiple compression related downdraft from 2022 has mostly run its course. While U.S. corporate earnings are currently expected to be virtually the same as last year, equity investors face the risk that earnings may decline year over year if the global economy slows.

With much of the U.S. economy on steady footing and continued strength in the labor market, 2023 growth is likely facing a mid-cycle adjustment rather than a deep contraction. If the U.S. does enter a recession, we believe it will be vastly different from the last two recessions (the Global Financial Crisis and the Pandemic-related recession) and be characterized as “the recession that didn’t bite.”

Outside of the U.S., we believe the change to a more pragmatic approach to COVID by the Chinese government will allow the economy to reopen more broadly and should result in renewed growth in the region. We are increasingly constructive on international and emerging markets.

Given our observations, optimism, and belief that equity valuations are compelling, we are generally back to our long-term target weights. We remain biased toward smaller companies and stocks with lower valuations.

We remain relatively bearish on bonds, preferring to invest in shorter maturity assets, given the likely higher interest rate environment.

While 2022 will be remembered as a very tough year for investors, great return years rise from the ashes of bear markets.

While many near-term uncertainties remain, we are focused on mid- to long-term investment opportunities. The markets are forward looking and will start to move before the data suggests. So, if the market is currently anticipating a slowdown next year and possibly even a recession, the market will rebound before growth improves and likely well ahead of any change in Fed policy.

Overall, we think 2023 is shaping up to be a positive year for the markets and we have recently increased client equity exposure as a result. As always, we will remain nimble and adjust investment positions as market events continue to unfold.

12/31/2022

Graphics source: JP Morgan Asset Management, 12/31/2022, unless noted otherwise.