Using Donor-Advised Funds to Steer Family Philanthropy

Have you established a donor-advised fund yet? If not, you are late to this party.

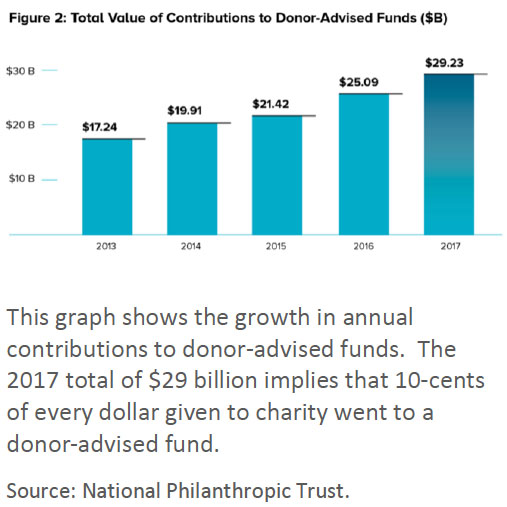

In 2017, there were almost 464,000 individual donor-advised funds, a 60% increase from 2016. According to the National Philanthropic Trust, grants from these funds to qualified charities increased almost 20% in these years.

In 2017, there were almost 464,000 individual donor-advised funds, a 60% increase from 2016. According to the National Philanthropic Trust, grants from these funds to qualified charities increased almost 20% in these years.

The growth rate of these charitable accounts is rivaled perhaps only by the growth of index investing and exchange traded funds. Yeah, that fast.

In 2018, 10% of all charitable gifts were made to donor-advised funds. And assets in these funds now exceed $100 billion.

Donor-Advised Fund Benefits

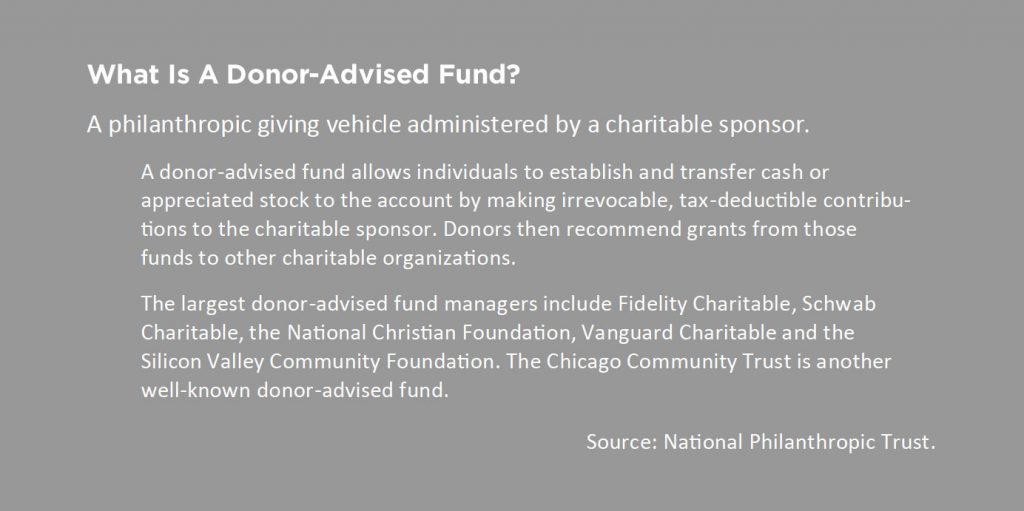

The history of donor-advised funds dates back almost a century. Regulatory changes and other improvements over the past 30 years have spurred their recent growth. Key reasons include:

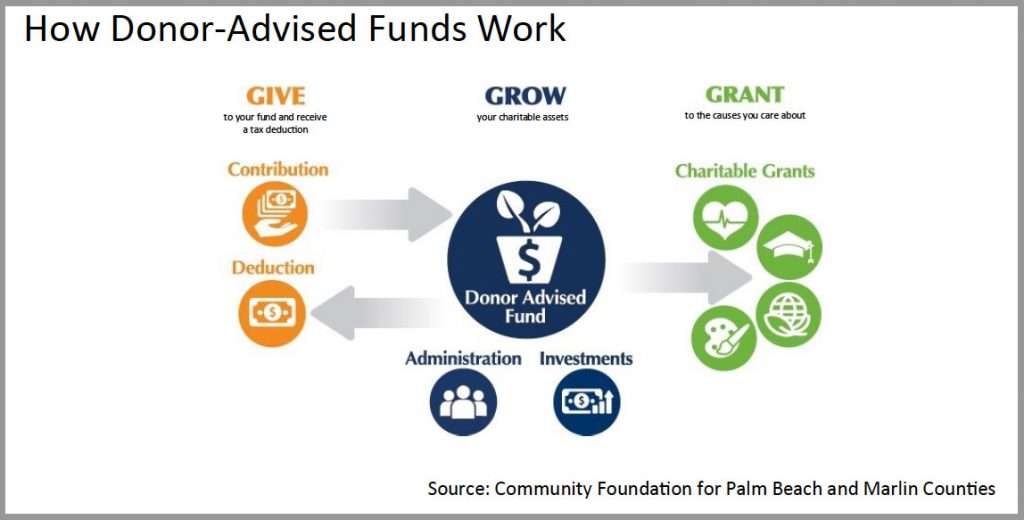

Simplicity: Like a private foundation, a donor-advised fund allows a wealthy individual to claim large tax deductions in one year and spread the actual grants to charities over a longer time horizon. These funds are easy to set up, simple to maintain and low cost. Plus, the sponsoring organization can make the grant-making process a breeze.

Double Tax Savings: If you contribute appreciated stock, you gain both a capital gain tax savings and an itemized deduction on your income taxes. Although many charities will gladly accept donations of appreciated stock, these transactions are often more complicated than simply giving cash, especially for smaller gifts. With a donor-advised fund, you make one large gift of appreciated stock to the fund, then give smaller amounts from your fund to charities in the future.

Lumping Charitable Deductions Into A Single Year: In the Tax Cuts and Jobs Act of 2017 (aka the Trump Tax Cut), the standard deduction for a married couple was increased to $24,000 and certain itemized deductions were reduced or eliminated. As a result, taxpayers who previously itemized deductions may now be taking only the standard deduction.

Consider this: If you take the standard deduction on your federal taxes, are you getting any tax credit for charitable contributions? No.

So, what can a charitable individual do to get the itemized deduction again? Instead of making small charitable donations each year, create a donor-advised fund and make one BIG contribution this year while spreading out the giving over the next few years. During the big year, itemize deductions on your taxes. During the next few years, take the standard deduction. This could be a money saver for you!

Which Tax Is More Significant: Income Tax or Estate Tax?

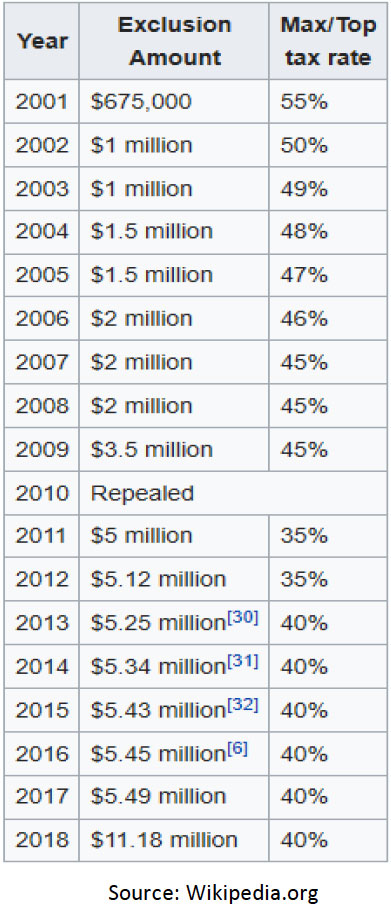

Historically, one benefit of creating a charitable foundation or donor-advised fund was to reduce the size of an individual’s assets for estate tax purposes. Two decades ago, estate tax could consume 55% of a family’s assets above $675,000.

Historically, one benefit of creating a charitable foundation or donor-advised fund was to reduce the size of an individual’s assets for estate tax purposes. Two decades ago, estate tax could consume 55% of a family’s assets above $675,000.

As the federal estate tax rate has declined and the individual exemption has increased, today the estate tax is 40% on assets above $11.18 million.

Even as the specter of estate tax has declined, the benefit of charitable giving during an individual’s lifetime has increased. Charitable giving now has a more important role in reducing capital gains and income tax.

Therefore, while individuals may have been advised to wait until their deaths to have a charitable foundation created, those individuals today may be advised to establish the foundation during their lifetimes.

Bringing Your Family Together

When discussing family values with our clients, giving to the less fortunate is one of the most common shared values. Family philanthropy is a way to use a family’s charitable intent to express values and bring multiple generations together around shared interests.

Whether creating a private family charitable foundation or a donor-advised fund, families can work together to identify which charities to support and which programs are most relevant to them.

For many wealthy families, being philanthropic can be a grounding experience and can encourage humility and gratitude to a hedonistic world. While anybody can be charitable, creating a foundation can help create a legacy of philanthropy for your clan.

Donor-Advised Fund or Private Foundation?

For many families, the issue is not donor-advised fund OR private foundation; many wealthy families have both. Private foundations can be beneficial long-term structures that endure from generation to generation. Donor-advised funds are easy to maintain and can be established for short periods of time for very specific purposes.

Donor-advised funds are so convenient that even some private foundations establish donor-advised funds to facilitate anonymous gift-giving. Think about that!

If you want to learn more about how to incorporate philanthropy into your family governance, tax planning or estate planning, let us know. We would enjoy having that conversation with you.