What Comes After the Basic Financial Plan? Trusts!

Simple financial plans typically include:

- setting financial goals

- establishing a budget

- creating an emergency fund

- reducing high-cost debt

- planning for retirement/education

- reviewing insurance coverage

Many individuals have been through this process and periodically review their financial plans. This is just the beginning for wealthy families. As wealth and complexity increase, so does the importance of creating and maintaining trusts.

For example, many wealthy individuals understand the benefit of donating appreciated stock to charity rather than cash. Additional benefits could be realized by using charitable lead trusts or charitable remainder trusts. Depending on a family’s goals, creating a family charitable foundation or donor advised fund also may be desirable.

Many wealthy individuals also have life insurance, either to replace lost income if they die unexpectedly or for diversification/investment purposes. Using a life insurance trust may have additional benefits for many reasons, including asset protection, managing gift taxes or estate taxes.

Meanwhile, many people plan to leave assets to their heirs. Statistically, the divorce rate for heirs is the same as the general population: about 50%. Few people want to leave money to a former son-in-law or daughter-in-law. Trusts can help in a divorce situation to keep assets within the family.

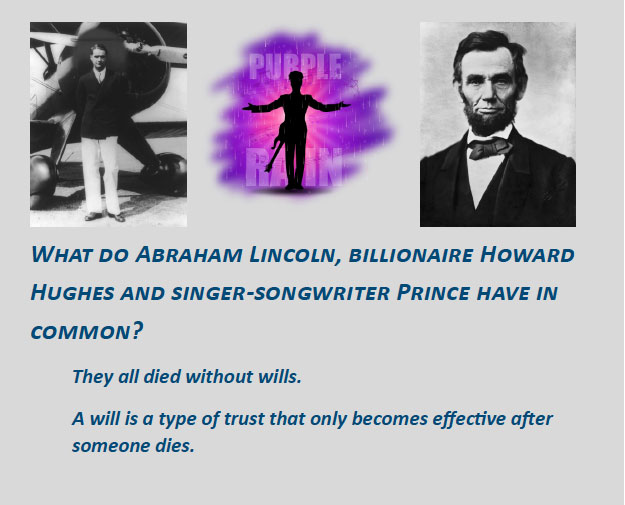

Often, people utilize a will to direct how assets are divided upon their death. A trust can help avoid a public probate process and potentially reduce the risk of a family member challenging the will.

Trusts are particularly useful for complex families. For example, a person with former and current spouses and children from different relationships could help ensure that assets are divided appropriately and avoid post-testamentary legal battles.

If a family owns a vacation home that they want to preserve for grandchildren and great-grandchildren, a trust could provide for the maintenance and operating costs.

Creating a trust requires a significant amount of effort and the assistance of a qualified attorney. But – similar to a financial plan – trusts need to be reviewed periodically and updated to achieve the maximum benefit. Families change, as do state laws that govern a trust.

Many people do not have the assets or complexity of a family like the Rockefellers, but even people with modest wealth can benefit from trust structures to protect and grow their assets for future generations.

Why would you need to update your current trust?

- Has there been a birth, death, marriage, divorce or re-marriage in the family?

- Does your current trust minimize the impact of federal and state tax income and estate tax?

- Is the original trustee still appropriate? What process exists to change the trustee?

- Are the investment powers sufficient?

- Do multiple trusts exist that could be distilled into a single trust?

If you know where your trust documents are located, read them annually, then schedule an appointment with your attorney to discuss possible updates.