FINANCIAL PLANNING

Anyone planning a summer vacation to France may find their travel plans upended by impassioned objections to changes in the French pension system bringing retirement age from 62 to 64. Photos of the protests evoke revolutionary paintings by Eugène Delacroix and Jacques-Louis David, with President Emmanuel Macron likely counting himself lucky the guillotine was retired a few decades ago. France’s work culture heavily emphasizes quality of life and high taxes are accepted in exchange for a comparatively early and comfortable retirement.

In the United States, our official retirement age is 67 (for those born after 1960) and early retirement is seen as a status symbol and the ultimate reward for a lifetime of hard work and success. However, anyone considering early retirement should explore possible hurdles before retiring – bridging health insurance, avoiding nest egg depletion, and maintaining a steady asset base that doesn’t start retirement on a trend-line toward zero.

Early Retirement in the USA – is $1 Million Enough?

Clients in their 50s often see the approaching finish line and start rapidly reprioritizing their plans. But the days of moving to Florida and living solely from Social Security are long gone for almost everyone. Longer lifespans, lower savings rates, inflation, higher real estate costs, stagnant wages, and fewer pension plans lead to many people being at risk of outliving their assets, even on a traditional retirement timeline. And wealthy people are at risk, too.

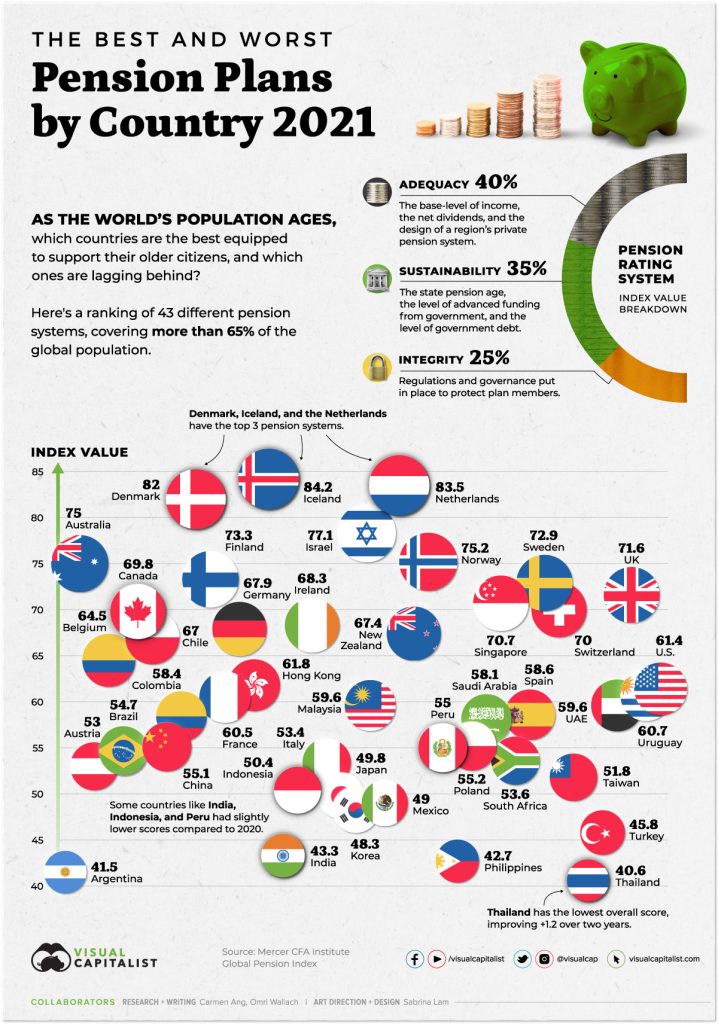

Last year, the US fell one spot to 18th place in a global retirement ranking due to inflation, market volatility, higher government debt, tax pressure, and an aging population, highlighting some factors that negatively impacted people who retired in 2022. According to a 2019 model run by the Employee Benefit Research Institute, 40.6% of all US households (including those with the highest incomes) age 35 to 62 are projected to run short of money in retirement.

Members of the FIRE movement (Financial Independence, Retire Early) believe that through frugality, extreme savings, and investment, they may be able to retire decades early and live solely from small portfolio withdrawals. But many people do not wish to live like this. If you don’t like the idea of living extra frugally in retirement – perhaps very differently than you did while working – this movement is probably not for you.

Meanwhile, headlines perpetuate the myth of the $1 million target retirement fund, but it’s not simple to determine what is “enough” for any individual. Variables such as portfolio composition, tax rates, financial commitments, goals and hobbies in retirement, personal health, size of family, and life partner’s age are all important inputs to calculating how much you will need to retire early. Even geography and likely lifespan matters – a 10-year retirement in St. Louis is significantly less expensive than 35 years in Honolulu.

Which Way Will Your Spending Go?

Spending plays a major role in both the lead-up to, and execution of, a retirement plan. Retirees of all income levels usually spend on a U-shaped curve, with higher spending in the early years when they are healthy and energetic, then a natural slowdown, and finally increased spending in the later years when health care becomes an issue.

But high-income retirees may have additional spending to consider: While they are trying to retire early, their children are just getting started and facing massive expenses. Parents may be planning to help pay all or some of higher education, a wedding, childcare expenses, or the down-payment on a house. These expenses are easier to cover during high salary working years, perhaps less so in the first years of retirement when the salary is gone. Working those few extra years may be enough to build enough savings to cover these large expenses for all of your children.

People wishing to retire early must also consider housing. While still employed, they should decide whether to downsize, move, or remain in place over the long term. The final years of work are a good time to pay off a mortgage and make major repairs and renovations – and not spend early retirement years doing construction on a primary property. Wealthy people may have the flexibility to buy a new home for retirement without needing to sell their primary residence, but that is a substantial outflow of funds if retirement has already begun.

And then there is health care, a major expense for almost all retirees. Wealthy people may easily be able to cover COBRA costs for themselves or their families (approximately $10K/year for an individual, $25K/year for a family), but it is a significant out-of-pocket expense and has limited duration. Medicare does not start for able-bodied people until age 65.

Fundamentals of Saving

Saving early and often, and investing what we save, is fundamental to general financial hygiene due to the incredible power of long-term compounding. Changes to the SECURE 2.0 Act are increasing and broadening access to retirement savings programs. Retirement vehicles function best when contributions are maximized and allowed to grow uninterrupted. Even wealthy people should maintain adequate liquid reserves to avoid the temptation of dipping into retirement funds for unexpected expenses.

The path to making an early retirement plan work rarely involves absolutes, but instead a mixture of thoughtful, interwoven components that include savings, spending, and a little wiggle room to manage the unpredictable nature of life.

Maximizing Income and Investments

The three biggest financial risks facing all retirees include longevity, inflation, and maintaining a sustainable annual withdrawal rate of less than 5% per year from their nest egg. We can fully or partially control savings, spending, asset allocation, employment earnings/duration, and longevity. But we cannot control market conditions or policy changes related to taxes and benefits.

While inflation – even at today’s 6% – may not trouble high net worth individuals, it does erode purchasing power and speed up the time it takes to reach the 5% threshold. Investment strategy then becomes that much more important.

The average annual rate of return for the S&P 500 has been about 9.8% since 1900. But most people don’t have a portfolio invested entirely in equities as retirement approaches, so they do not reach 10% (even in a theoretical perfect market). People retiring today are facing headwinds, and withdrawals for early retirement can ravage a portfolio. Early retirees should consider investment solutions that incorporate downside protection strategies and remember that time in the market is the ultimate tool for success. They should choose an approach favoring conservative returns focused on reliability of income and adjust spending based on market conditions to help make money last.

The final years of work – often at the highest salary levels in a career – are key to maximize a “nest egg” to further insure a comfortable retirement. To retire early, be sure to take advantage of all investment possibilities in your final years of work. If you can, make the annual contributions to retirement vehicles including the “catch-up contribution” for you and your spouse/partner after age 50. Early retirees will not be able to immediately draw on Social Security (optimal age is 70 to maximize benefits), and taking early distributions from pensions and retirement plans can mean missed opportunities for compounding. Meanwhile, the years between career earnings and Social Security benefits are prime time for Roth IRA conversions.

The earning years at the end of our careers tend to be the biggest of our lives so even one extra year can make a substantial impact on financial plans. But early retirement should be less about ceasing to work, and rather about gaining complete control of our time. Exploring options for a sabbatical, part-time work, or subsequent career may play a role in finding the right solution. A rewarding second act after leaving a primary career can also offer modest income to offset living expenses and potentially offer benefits like health insurance to resolve the question of bridge coverage.

How Conifer Bay Capital Can Help

After decades in a high-pressure job, it can be tempting to sprint to a black and white solution like permanently ending a working career. But our modern retirement system was not designed to support decades of leisure time. Financial planning provides wise saving and spending strategies for retirement years.

A few key considerations for people questioning whether to retire early:

-

More flexibility in when to retire often leads to a better chance of success.

-

All traditional retirement resources should be included when considering assets to use in retirement: deferred income, corporate pensions, 401(k)s, IRAs, Roth IRAs, life insurance cash value, annuities, Social Security, income properties, investment portfolios, and any inheritance.

-

When considering annual expenses, break them into fixed and variable costs. Variable costs can be trimmed if finances are running out faster than expected (getting too close to the 5% threshold).

-

Separate essential expenses from discretionary ones (travel, dining out, car upgrades, gifting to children and grandchildren), which can be forgone if assets decline.