Aging & Caregiving: Planning for Elder Care

by Lindsay Guido, CFP®

What do Rob Lowe, Dwayne “The Rock” Johnson, and all four Baldwin brothers have in common? They played starring roles as caregivers to their elderly parents.

Seth Rogen and his wife founded Hilarity for Charity while providing care to his mother-in-law suffering early-onset Alzheimer’s. They are in good company with Brooke Shields and Jodie Foster who also provided Alzheimer’s care to their mothers, both as so-called “sandwich caregivers,” raising children and caring for an older loved one simultaneously.

These celebrities are not alone. Elder care is, and will continue to be, a critical need in the US as the population ages. While often rewarding, unpaid care can come at a financial cost to the caregiver in terms of reduced paid work hours, lost wages, and lower retirement income. What can caring people, celebrities and otherwise, do to help themselves? Make a proactive plan and care for themselves while also caring for their family members.

While most families’ care is provided without the benefit of public adulation, the personal struggles and concerns of caregivers are universal both emotionally and financially. All the more reason to carefully plan and consider the financial implications for the caregivers and the person receiving the care.

Women constitute the majority of paid caregiving workers, and women 55 and older account for more than one-third of people providing unpaid elder care in the U.S at 26.6 million hours daily, amounting to over 25 days of full-time unpaid work per individual per year. There are financial penalties to performing these roles, and women, in their later income-generating years, are less likely to make up any forgone earnings.

Most people would not think to consult their investment advisor when addressing elder care, but financial planning advice can be critical to selecting a family’s best strategies. The first step to building a solid plan is to lay out all the pieces so that caregivers and care receivers are being treated fairly and equitably, and everyone involved is working toward the best outcomes. This involves developing a Care Plan, communicating goals for care, and determining the financial impact of the chosen strategy.

Plan for Care – the Who, What, Where, and How

Families will need to determine the details of providing care, particularly the who and where. The first step is to develop a Care Plan to sort out the details of people, place, and cost. The Care Plan clarifies who will serve as caregiver and advocate (sometimes the same person), the desired outcomes, confirmation that all medical services are correct and necessary, and that everything possible is being done to improve the situation.

When a caregiver is selected, the family needs to determine how and what the caregiver will be paid, which is particularly relevant if that person will sacrifice a paid position to do so. The funds to compensate a caregiver should come from the care recipient’s assets/estate (as it would for a professional home aid) and be exhausted before any other family members start footing the bill.

The primary caregiver also needs support from the rest of the family. It is wise to create and document informal family agreements including scheduling expectations to avoid conflicts down the road.

The where often requires lengthy research. Will the care be received at home or in a facility? Getting great facility care means looking in advance, asking around, making multiple visits, and getting to know other families in the fold. Choices include life care communities, skilled care, and assisted living. Considerations for the best fit should include location (usually near the patient’s existing community or the primary caregiver’s home), services offered, and ownership (which governs the facilities’ priorities). Be aware, some facilities have waiting lists.

Visit your facility of choice to understand its culture and standards, as well as the quality and quantity of staffing. Carefully evaluate any contract to determine what is included, what costs extra, service limits, frequency of fee increases, and whether patients can be forced to leave for any reason. Well-meaning family members should also be on the lookout for arbitration clauses, and careful not to waive their own rights, clarifying that only the patient is responsible for these costs.

Home care includes additional coordination challenges such as issues with long-term-care insurance and details involved with retaining household staff. When it comes to hiring help, recommendations from friends and neighbors, as well as local schools with Certified Nursing Assistant programs and hospice workers can be valuable resources.

People who hope to remain in their current homes should seek an evaluation from an aging-in-place consultant who can confirm whether the home is aging-friendly. Those moving to a new area should ensure the availability of people and services needed, particularly in rural communities.

Care Plans must be regularly revisited to ensure that the desired outcomes are being met in terms of quality of care, costs, etc. Needs change over time and failure to address changing priorities is likely to result in inappropriate care.

Declining Health Requires Quick Action

The Art of Dying Well by Katy Butler suggests that the last years of someone’s life may play out in this order: aging in good health, a slowdown, serious illness, frailty or dementia, the medical “roller coaster/treadmill” (cycles of deteriorating health punctuated by periods of short-lived rejuvenation) and finally, terminal illness.

A person with a good quality of life still retains abilities in communicating, interacting, grooming, and nutrition. Engaged patients know and participate in the goals of their care, and can still reasonably work with their families to determine the best care plan for them. They understand their medical problems and treatments and take responsibility for their own recovery. Some other people may have the “dwindles” (also called “failure to thrive”), which affect about 2 of 5 elderly people and manifest as reclusiveness, a lack of appetite, declining energy, and disengagement with recuperative efforts. When patients check out emotionally and mentally, care-related conversations are urgent.

While declining health is a difficult topic to broach, it’s important for patients, family, and health providers to share an aligned vision that supports the patient’s choices, even those which may be difficult for loved ones to accept. Otherwise, patients can unintentionally remain in limbo for years, without an opportunity to reassess a next course of action which may be to pursue further medical treatment, palliative care, or hospice.

Covering Costs

Even families with deep pockets should consider all of the financial resources available to pay for elder care. A long illness at the end of someone’s life can get very expensive, and the elderly person may hope to maintain previously established priorities, such as preserving a legacy for heirs. They may not wish to spend their children’s inheritances on expensive care for themselves. Within wealthy families, fairness is a subject that often comes into play and no single heir should be left to bear the burden of covering costs out of their own pocket, or through opportunity costs like missed wages. Adult children also may be compelled to navigate elder care while managing precarious financial situations of their own, such as job loss, divorce, etc. Depending on an elderly parent’s estate details, adult children may not have power of attorney over parental assets, and must consider funding for care from a variety of sources such as savings, family assistance, government benefits, and long-term-care insurance.

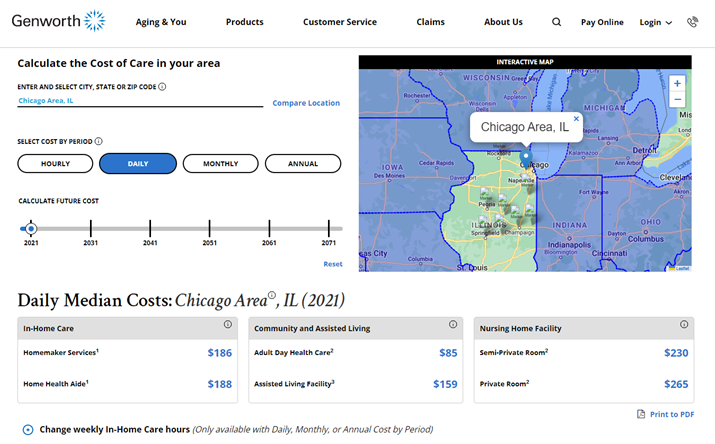

To approximate costs of elder care, Genworth’s calculator can estimate expenses on multiple bases, illustrating the impact of a variety of lifestyle choices in different geographic areas.

When considering funding sources, particularly savings versus long-term-care insurance, it is helpful for the caregiver and care receiver to ensure that they – and the rest of the family – are on board. Encourage transparency and remain aware of estate planning considerations. Keep precise records including those for accounting purposes, employer taxes, and liability/workers’ comp insurance for private caregivers.

The future of government assistance is always uncertain with changing times and legislation, but information about these programs is plentiful. State and local resources offer free health insurance counseling for Medicare beneficiaries and their caregivers from State Health Insurance Assistance Programs (SHIP), comprehensive health services for seniors from Program of All-Inclusive Care for the Elderly (PACE), and Veterans Affairs (VA.)

If using long-term-care insurance, it is important to understand the benefits, processes, and other conditions including exclusion periods for home care and facilities, respite care, and timing related to claims as well as coverage for preferred providers.

Other funding sources may include hybrid life and long-term-care insurance policies, which can segregate money for care, and some standard life insurance policies with riders for long-term care or accelerated death benefits. In some cases, a reverse mortgage may be appropriate to meet funding needs. In general, it is worth exploring all options as part of a family’s overall Care Plan.

How Conifer Bay Capital Can Help

Caregivers attending to physical or household needs of elderly relatives often overlook that they may be required to provide financial assistance or advice; without proper support or experience, they may be underqualified for this important role.

Conifer Bay Capital can help clients and their families with an approach that begins early to cultivate financial and legal preparedness and an awareness of options. As needs progress, we remain dedicated to the management of cash flow, taxes, timing, and family governance. For an optimal outcome, funding is strategically drawn from available vehicles to cover costs in a way that is tax efficient, focused on capital preservation, and considers potential estate and family complications.

Before difficulties arrive, we encourage clients to partner with loved ones and estate attorneys to enact advance directives and communicate wishes for critical decisions as a component of their holistic personal financial plan.

The Best Solutions

One of life’s greatest honors may involve selflessly putting our own life on hold to tend to a loved one in need, often for someone who once cared for us. Henry Winkler, television’s Fonzie and celebrity caregiver, is quoted as saying, “My hat is off to caregivers. My respect is at full tilt.” We all understand that caring about others is, in itself, a heroic act. These topics take courage to confront for ourselves and for our loved ones, but an ounce of prevention is worth a pound of cure.

Another celebrity caregiver, Queen Latifah, reminds us that no one can pour from an empty cup. “There can never be enough support for caregivers … that support has to start within themselves.” For the benefit of caregivers and care recipients, plan as much as possible in advance, stay organized, get help early, and stay on top of taxes and cash flow needs along with physical and emotional needs. And remember, help is always just a phone call away.